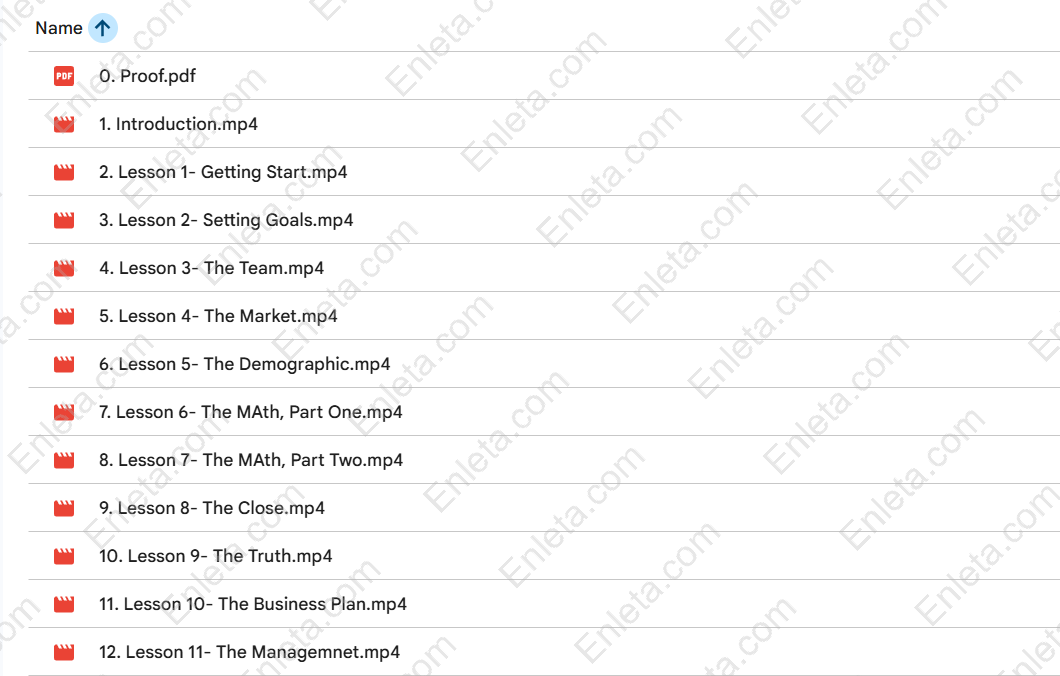

🔥 Ultimate 11 Lessons in Real Estate Master Course for Confident Deal-Making | Instant Download!

For $93.1, you get 5.44GB of step-by-step training inside the 11 Lessons in Real Estate Master Course by Ken McElroy—an 11-lesson investing blueprint built to help you go from unsure beginner to confident deal evaluator, operator, or passive investor.

This course is designed for real-world action. Whether your goal is to write your own offers, learn the basics of syndication, or invest passively with greater confidence, the 11 Lessons in Real Estate Master Course gives you a structured learning path that mirrors how deals actually happen: you start, set goals, build a team, choose markets, analyze numbers, secure a property, execute due diligence, build a business plan, and manage the investment.

Instead of drowning in theory, you’ll get the practical sequence that experienced investors follow—taught in a way that helps you make clearer decisions faster. If you want a course that’s straightforward, actionable, and focused on deal fundamentals, this is one of the most efficient ways to build your base.

💼 Free Proof Download – Verified High-Quality Content Included

Get instant access to our official, verified materials — designed to deliver trusted, professional content you can use right away.

🎬Introduction | Watch the Official Video Sample:

Preview the full experience through our official video and see exactly what’s included in the downloadable version.

✅Verified Proof of Content Quality:

Explore verified credentials and quality assurance details confirming the authenticity and accuracy of the material.

⚡ Powerful Outcomes to Invest Smarter and Avoid Costly Mistakes

Real estate investing isn’t hard because the concepts are impossible—it’s hard because you’re forced to make decisions with incomplete information. Most investors lose money not from bad intentions, but from weak fundamentals: poor market selection, wrong assumptions, sloppy underwriting, or unclear plans after closing.

The 11 Lessons in Real Estate Master Course is built to help you reduce that risk. It teaches you the exact thinking process you need to evaluate opportunities with logic—not emotion.

Here’s what you can expect to gain:

-

A clear roadmap for getting started without overwhelm

-

Stronger goal-setting so you know what to buy (and what to ignore)

-

A practical framework for assembling a team that protects your downside

-

Market and submarket selection skills that improve long-term performance

-

A better system for gathering numbers and verifying cash flow

-

Confidence writing offers and getting deals under contract

-

A focused due diligence checklist mindset—what to watch and why

-

A simple business plan approach to improve execution

-

A management framework to protect returns after purchase

If you’ve been stuck watching videos and reading books without making progress, this course helps you convert learning into structured action.

🚀 Game-Changing Blueprint to Start Investing the Right Way

Getting started is often the hardest part because there are too many paths: flipping, rentals, multifamily, short-term rentals, syndications, passive deals, REITs, and more. The course begins with a grounded introduction and then moves into how to take the first steps with direction.

In the 11 Lessons in Real Estate Master Course, the early lessons are designed to answer the questions that stop most beginners:

-

What does “good investing” actually look like for your life?

-

How do you choose a strategy that fits your time, money, and risk level?

-

What should you learn first so you don’t waste months chasing noise?

You’ll learn how to approach investing like a business: define your objective, understand the game you’re playing, and build a plan that makes execution possible. This is especially valuable if you’re the type of learner who needs a clear structure instead of random tips.

🧭 High-Impact Goal Setting to Build a Real Investing Strategy

Many investors say they want “cash flow,” but don’t define what that means. Others say “wealth,” but don’t connect it to a measurable plan. That’s why goal-setting is a core pillar in this course.

The 11 Lessons in Real Estate Master Course helps you develop goals that guide decisions:

-

Your time horizon (1 year vs. 10 years changes everything)

-

Your cash flow target (what the property needs to produce)

-

Your risk tolerance (and what you must avoid)

-

Your scalability plan (how you grow from one deal to a portfolio)

Once goals are defined, market selection, property type, financing choices, and deal criteria become far easier—and you stop chasing random opportunities.

🧱 Proven Team Building to Protect Your Investment and Increase Returns

Real estate is a team sport. Even “solo investors” rely on brokers, lenders, property managers, inspectors, attorneys, and contractors. The wrong team can destroy a great deal; the right team can rescue a mediocre deal.

This lesson inside the 11 Lessons in Real Estate Master Course focuses on building an all-star team that sets you up for success. You’ll learn how to think about:

-

Who you need before you buy

-

How to select professionals who reduce risk

-

What questions to ask to identify competence

-

How to build a system where team members work together

This alone can save you thousands of dollars and months of stress—because your team shapes the quality of your execution.

🔥 Secret 11 Lessons in Real Estate Master Course for Choosing Profitable Markets

One of the most important skills in investing is knowing where to buy. A great property in the wrong market can underperform for years. A decent property in a strong market can grow steadily and recover from mistakes.

In this section of the 11 Lessons in Real Estate Master Course, you learn how to identify the right market and submarket by thinking like a professional investor:

-

Why market fundamentals matter more than hype

-

How submarkets can outperform city-wide averages

-

What to examine when comparing locations

-

How to use demographics and demand signals correctly

This is where many new investors go wrong—they buy where they “feel comfortable” instead of where the numbers and trends support long-term stability. This lesson helps you choose markets with confidence.

📊 Unstoppable Deal Math to Confirm Cash Flow Before You Buy

The math is where investing becomes real. You can love a property, trust the broker, believe the story, and still get crushed if the numbers don’t hold up.

The course breaks “the math” into two parts to help you understand underwriting without confusion:

-

How to gather accurate numbers and information

-

How to test assumptions (rent growth, expenses, vacancy, capex)

-

How to evaluate whether the deal truly cashflows

-

How to avoid common underwriting traps

The best part? It’s taught in a way that keeps you focused on what matters: the story must match the numbers, and the numbers must survive stress tests.

👉If you want a practical course that helps you evaluate deals, select markets, and build a real investing process, the 11 Lessons in Real Estate Master Course by Ken McElroy is a strong, no-fluff option. Get it today and start investing with clearer thinking and stronger fundamentals.

✍️ Powerful Offer Writing to Get Deals Under Contract

Investors don’t get paid for analyzing—they get paid for executing. That’s why writing an offer and getting a deal under contract is its own skill set.

This part of the 11 Lessons in Real Estate Master Course teaches you:

-

What matters most in an offer

-

How to structure terms to reduce risk

-

How to communicate professionally and win trust

-

How to move from interest to signed contract

This lesson helps you stop treating offers as “scary” and start seeing them as a natural step in the deal process. The more offers you write, the more deals you’ll learn from—and the faster you build real investing momentum.

🔍 Essential Due Diligence to Avoid Surprises and Strengthen Your Business Plan

Due diligence is where deals are saved or destroyed. New investors often focus on the wrong details while missing the items that actually impact cash flow and operations.

Inside the 11 Lessons in Real Estate Master Course, you’ll learn what to focus on during due diligence so you can:

-

Verify the truth behind the numbers

-

Identify hidden risks early

-

Confirm renovation and capex needs

-

Understand operational inefficiencies

-

Protect yourself before closing

This is also where you build confidence. When you have a clear due diligence process, you stop feeling like you’re gambling—and start feeling like you’re operating.

🧠 Strategic Business Planning to Create Value After Closing

Buying a property is not the finish line—it’s the start. The business plan determines whether your investment becomes a stable performer or a constant headache.

This lesson teaches you how to create a business plan that actually works:

-

What to prioritize first

-

How to set measurable targets

-

How to plan renovations and rent increases responsibly

-

How to track progress and adjust strategy

A strong plan also helps with partnerships and syndications because it proves you’re thinking like an operator. The 11 Lessons in Real Estate Master Course helps you build a plan that supports real-world execution, not fantasy projections.

🏢 Smart Management Systems to Protect Cash Flow Long-Term

Most investors obsess over buying but forget that management is where money is made—or lost. Poor management can erase returns even in a strong market. Strong management can improve NOI, reduce vacancy, and create stability.

In the final lesson, the 11 Lessons in Real Estate Master Course emphasizes:

-

What matters most in ongoing management

-

How to oversee performance without being overwhelmed

-

How to evaluate a property manager properly

-

How to protect cash flow and maintain standards

Management is not just “maintenance.” It’s the ongoing business operation that determines whether your asset becomes a wealth-building machine.

👤 Author Introduction: Who Is Ken McElroy?

Ken McElroy is a well-known real estate investor and educator recognized for teaching practical, scalable investing principles—especially around multifamily and long-term wealth-building. His style is straightforward: focus on fundamentals, build strong systems, and learn how to evaluate deals with clarity.

What makes Ken’s approach valuable in the 11 Lessons in Real Estate Master Course is that it doesn’t rely on hype. Instead, it focuses on repeatable frameworks that help investors make better decisions—whether you’re investing actively, learning syndication, or planning to become a passive investor with a sharper eye.

If you want education that prioritizes process and execution over motivation, Ken McElroy’s teaching is a strong fit.

❓ FAQ: Frequently Asked Questions

Is the 11 Lessons in Real Estate Master Course good for beginners?

Yes. The course is structured to help beginners understand the investing process from start to finish, including markets, math, offers, due diligence, and management.

Does the course cover syndication and passive investing?

Yes. It’s designed for people who want to write their own deals, learn syndication concepts, or invest passively with stronger evaluation skills.

Will I learn how to analyze if a deal cashflows?

Absolutely. The course includes “the math” lessons that teach you how to gather numbers and confirm that cash flow holds up.

Does it teach market and demographic analysis?

Yes. Lessons include market and submarket selection as well as demographic evaluation to help you choose stronger locations.

🔥 Unstoppable 11 Lessons in Real Estate Master Course for Profitable Investing Skills

For $93.1, you get 5.44GB of clear, actionable training inside the 11 Lessons in Real Estate Master Course by Ken McElroy, built to teach you how to start investing, evaluate deals, select the right markets, write offers, execute due diligence, create business plans, and manage investments with confidence.

This is the kind of course that replaces confusion with structure. Instead of guessing, you learn the real sequence: start → set goals → build the team → choose markets → evaluate demographics → do the math → close → verify truth → execute the plan → manage the asset.

If you’re serious about becoming a smarter investor—active or passive—this course gives you the fundamentals that protect your money and sharpen your decision-making.

👉Get the 11 Lessons in Real Estate Master Course today and start investing with confidence.

Reviews

There are no reviews yet.