Actionable Options Program by Dan Darrow – Instant Download!

The Actionable Options Program (AOP) is a structured training course led by veteran trader Daniel Darrow, offered through T3 Live. The course is built around real-world application rather than theoretical complexity—it distills what matters into pragmatic strategies you can execute. You receive roughly 3 hours of video instruction and a 296-page course guide, covering a complete, battle-tested options trading methodology.

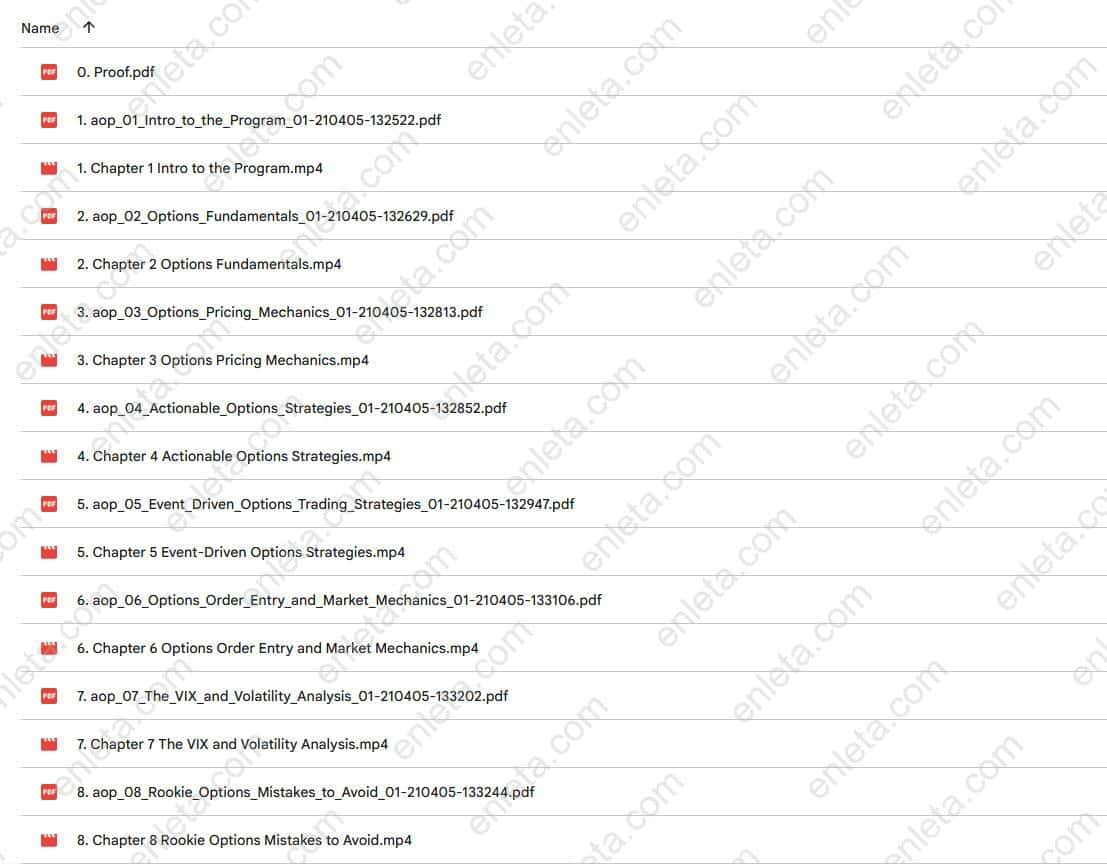

Actionable Options Program by Dan Darrow Free Download – Includes Verified Content:

Actionable Options Program – Free Download Video Sample:

Actionable Options Program Free Download, Watch content proof here:

PDF Sample – Actionable Options Program, watch here:

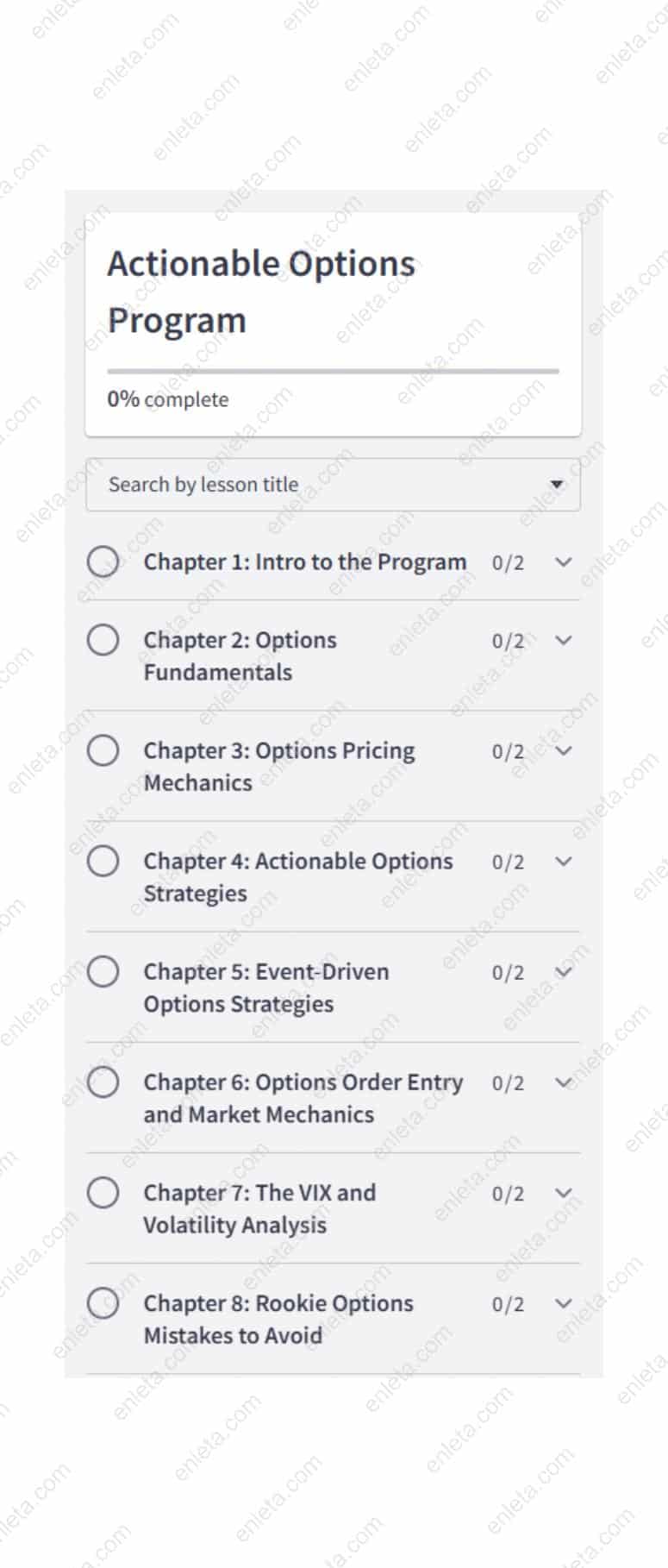

Actionable Options Program – Overview This Course

From the foundational mechanics of options to advanced strategies and volatility management, this program places emphasis on clarity, simplicity, and real profitability. The aim is to help learners bypass noise and focus on what actually moves P&L in live trading.

Why Should You Choose This Course?

-

Taught by a real professional: Daniel Darrow has been trading options and equities since 2006. His method reflects years of experience rather than speculative theory.

-

Simplicity over complexity: Darrow throws out the 99% of options theory that rarely moves the needle, keeping only the essential pieces.

-

Balanced approach to strategy and event trading: In addition to core strategies, you learn event-driven options strategies (earnings, news, catalysts) allowing you to trade during high-volatility windows.

-

Instruction on order execution and trade mechanics: Many courses neglect entry techniques and order nuance; this program covers executing in volatile environments, dealing with slippage, and market mechanics.

-

Risk awareness central: It doesn’t glorify large gains without attention to risk; trade selection, volatility evaluation, and avoidance of common pitfalls are integral.

-

Accessible even for beginners: The course starts from basics and builds upward. You won’t need an advanced mathematical background, yet you’ll gain actionable knowledge.

What You’ll Learn

When you complete the AOP program, you will be able to:

-

Grasp the essential building blocks of options—intrinsic vs. time value, moneyness, and the behaviors of calls and puts—in a language you can execute immediately

-

Understand implied volatility, theta decay, and other “greeks” in a practical sense—how they affect trade dynamics and decision making

-

Use 10 core “bread and butter” options strategies (spreads, butterflies, calendars, hedging tools) adapted for real market conditions

-

Apply 4 event-driven strategies designed to take advantage of earnings, macro events, FDA decisions, and other data releases

-

Judge which trades to take—and which to avoid—by filtering through volatility, underpricing, and event risk

-

Enter and exit trades cleanly: how to place orders, manage execution, and handle slippage or adverse price action

-

Sense and adapt to volatility regimes using VIX term structure and advanced volatility analysis beyond surface indicators

-

Recognize rookie mistakes, avoid emotional domino effects, and maintain discipline through trade reviews and structured frameworks

By internalizing these competencies, you’ll evolve from reactive trader to strategic decision-maker in options markets.

Who Should Take This Course?

This training is best suited for:

-

Traders who already have a basic understanding of stocks or markets and want a pathway into options

-

Individuals seeking a systematic, sustainable approach to options rather than hype-driven “get rich quick” systems

-

Traders who wish to harness event-driven volatility rather than avoid it

-

Those comfortable with risk and willing to practice order execution in real, noisy environments

-

Learners who want transparent frameworks, actionable strategies, and guidance on trade mechanics

This course may not be ideal for:

-

Absolute novices to markets or financial instruments with no foundation in trading

-

Those expecting guaranteed returns without applying discipline or iteration

-

People unwilling to learn execution nuances, deal with volatility, or refine strategy over time

Conclusion

If you want a direct, practical, and resilient approach to options trading, enrolling in Actionable Options Program arms you with strategies, execution skills, risk management habits, and event orientation to operate in real markets. The course combines clarity, discipline, and experience into a trading methodology you can implement with confidence.

👍Enroll today and begin trading options with clarity, conviction, and strategic edge.

Reviews

There are no reviews yet.