AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha by Laurence Connors | Instant Download!

AI is the new frontier of market alpha.

In AI For Traders: A Professional Manual for Hedge-Fund-Level Alpha, Larry Connors reveals how artificial intelligence has become the most powerful source of trading edge in modern market history.

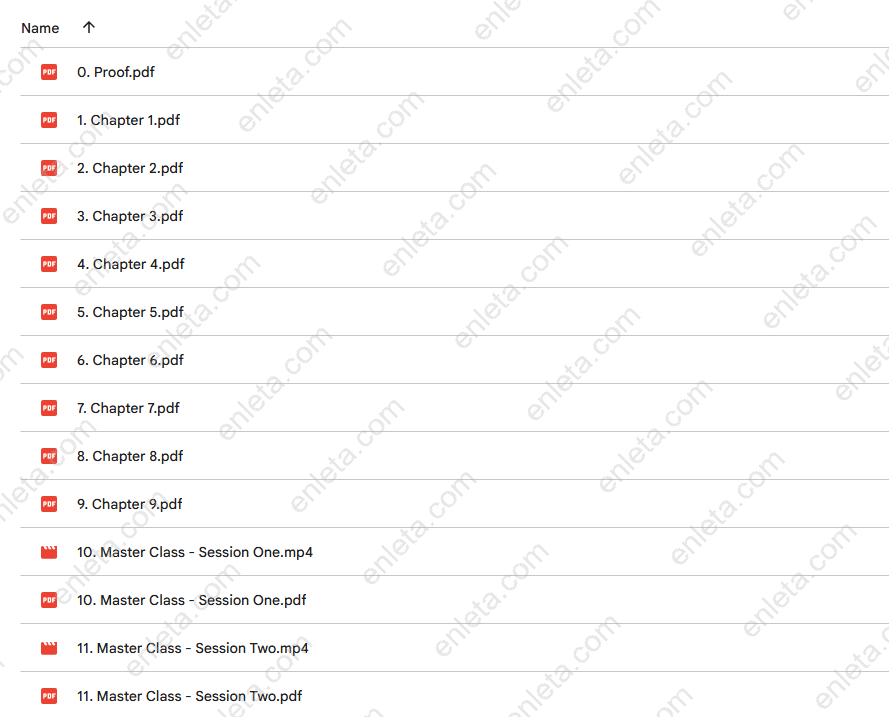

With 1.37 GB of exclusive content priced at $93.1, this program provides a complete institutional-grade playbook that teaches you how to combine your trading expertise with AI’s data-driven intelligence — creating a new level of predictive power known as Cognitive Analysis.

💼 Free Download – Verified High-Quality Content Included

Get instant access to our official, verified materials — designed to deliver trusted, professional content you can use right away.

✅ Verified Proof of Content Quality:

Explore verified credentials and quality assurance details confirming the authenticity and accuracy of the material.

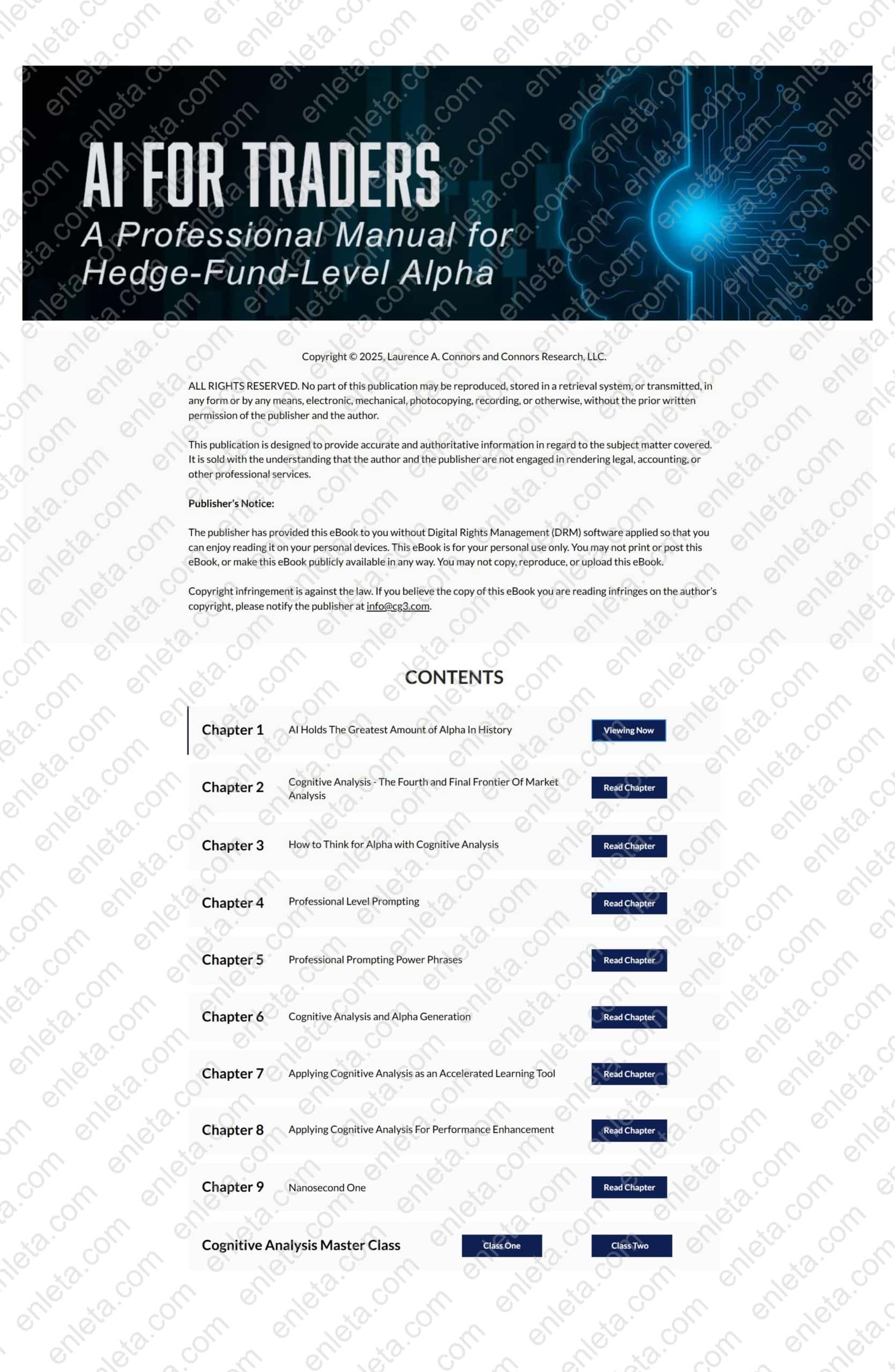

📄 Preview the Free PDF Sample:

View a high-resolution PDF excerpt to check the structure, design, and depth of information before downloading the complete file.

AI Trading Course – Why This Manual Redefines Alpha Generation

For decades, traders relied on fundamental, technical, or quantitative analysis to find profitable edges. But Connors exposes the truth: those sources of alpha have largely disappeared.

-

Fundamental edges have been arbitraged out — over 78% of large-cap managers underperform the S&P 500.

-

Technical analysis shows minimal statistical edge in modern markets.

-

Quantitative models are now crowded and offer returns barely above Treasury bills.

The solution? Cognitive Analysis — a revolutionary discipline that fuses human trading intelligence with the vast memory and processing speed of AI. Connors demonstrates how this hybrid model allows traders to extract new, sustainable alpha before institutions react.

This isn’t another theory — it’s a hedge-fund-tested methodology that empowers solo traders to operate with institutional precision.

Learn AI for Trading Step by Step for Real Market Advantage

Each chapter of Connors’ manual builds a new level of professional edge — from rethinking analysis to creating repeatable AI workflows for live trading.

1. AI Holds the Greatest Amount of Alpha in History

Discover why AI represents the most significant evolution in trading since algorithmic execution.

Key takeaways:

-

How to complete in 20 minutes what once required an entire hedge-fund research team.

-

A data-backed comparison showing how traditional edges have vanished.

-

A 20-minute AI workflow to analyze your top positions and uncover hidden opportunities overnight.

This opening module instantly reframes how you perceive speed, information, and market advantage.

2. Cognitive Analysis – The Fourth Frontier of Market Intelligence

Learn how Cognitive Analysis replaces outdated FA, TA, and QA with a unified system that leverages AI’s market memory.

Highlights:

-

20-year performance data proving why traditional edges have failed.

-

“Edge Migration Map” revealing where alpha has moved within AI models.

-

A Reallocation Blueprint showing how to shift capital and time toward AI-driven workflows.

After this module, you’ll know how to systematically identify inefficiencies that others overlook — and monetize them.

3. Thinking for Alpha – How to Build Higher-Order Trading Insight

Connors teaches “second- and third-order thinking,” the reasoning approach behind institutional alpha.

You’ll learn to:

-

Analyze cause-and-effect relationships beyond price charts.

-

Detect sector-level rotations weeks before Wall Street analysts.

-

Apply a three-question checklist to filter trades for asymmetric potential.

This module trains your brain to think like an AI — pattern recognition, probability mapping, and causal reasoning combined.

4. Professional-Level Prompting – The Three-Step Blueprint

Your results depend on the quality of your questions. This section reveals how hedge-fund teams use AI prompts for fast, actionable insights.

Key advantages:

-

Craft concise, data-rich queries that yield immediate trade setups.

-

Replace days of manual research with one structured prompt.

-

Scale consistent insight quality across your entire trading team.

Once mastered, every prompt becomes a precision trading instrument.

5. Five Prompt Amplifiers – Turning AI Into an Edge Engine

Connors introduces the “Professional Power Phrase Toolkit,” allowing traders to refine every AI interaction for deeper alpha discovery.

Core outcomes:

-

Access hedge-fund-grade clarity in seconds.

-

Compress research time by up to 80%.

-

Standardize your analytical process across markets and timeframes.

This is how professionals harness AI’s cognitive depth — guiding it toward insight rather than noise.

6. Building Repeatable Alpha with Cognitive Analysis

Go beyond theory and watch Connors apply these tools to real-world examples:

-

Spotting the rise of quantum computing stocks (QBTS and IONQ) months before the market caught on.

-

Turning one line from a trading book into a leveraged ETF strategy.

-

Extracting tradable opportunities from brief Wall Street Journal blurbs.

-

Reverse-engineering billionaire investor Seth Klarman’s philosophy into repeatable portfolio tactics.

This is alpha engineering — where curiosity, AI, and systematic thinking intersect.

7. CALC: Compressing Weeks of Learning Into Hours

This chapter unveils CALC — Cognitive Analysis Learning Center, Connors’ proprietary AI engine that transforms learning into a real-time adaptive process.

Features include:

-

Personalized curriculum adapting to your pace and accuracy.

-

Dynamic quizzing that turns every question into instant mastery.

-

Real-time strategy generation for breaking market events.

What used to take months of research now fits into hours — giving you a permanent informational edge.

8. Trading Psychology Optimized by AI – Mindset Meets Machine

Connors integrates AI into trader psychology, delivering continuous feedback and behavioral optimization.

What you’ll gain:

-

24/7 digital coaching based on Mark Douglas and Dr. Ari Kiev’s methods.

-

A 48-question behavioral blueprint to identify strengths and blind spots.

-

Emotional resilience frameworks that prevent drawdown panic and cognitive dissonance.

This is the first system where AI actively improves your discipline as much as your data.

9. Embedding Cognitive Analysis Into Your Daily Workflow

Connors concludes with a 15-minute-a-day routine that transforms theory into daily performance.

Implementation steps:

-

Morning and evening AI review checklists.

-

Team-ready templates for scalable workflow sharing.

-

Automatic update cycles to maintain your alpha edge as models evolve.

By the end, Cognitive Analysis becomes muscle memory — part of your trading reflexes.

AI for Traders Benefits That Deliver True Professional Edge

AI For Traders is designed to upgrade both your strategy and mindset, offering benefits unmatched by conventional courses:

-

Learn to extract fresh alpha from AI in hours, not years.

-

Operate with institutional-grade efficiency as a solo trader.

-

Build repeatable, data-driven strategies grounded in cognitive logic.

-

Enhance mental clarity, decision-making, and confidence.

-

Future-proof your trading edge as markets evolve.

This is not about automation — it’s about augmentation: using AI to magnify human intelligence.

Trading Skills You’ll Master from This AI for Traders Course

By completing Connors’ manual and bonus materials, you’ll master:

-

Building AI-powered trading workflows

-

Designing professional prompts for market analysis

-

Applying cognitive models for sector prediction

-

Creating systematic trading strategies from real-time data

-

Improving execution discipline through AI-feedback loops

-

Embedding daily analytical routines for consistent edge

These are the same practices employed by top hedge-fund research teams — now in your hands.

Is This AI for Traders Course Right for You?

This program is built for serious market participants:

-

Professional traders seeking to upgrade to AI-driven analysis

-

Retail investors ready to think and act like institutions

-

Quant developers interested in cognitive edge creation

-

Portfolio managers pursuing faster, evidence-based decisions

If you’re ready to stop guessing and start systematizing, this course gives you the exact blueprint.

About Laurence (Larry) Connors – Trading Innovator & Research Pioneer

Larry Connors has spent over four decades shaping professional trading education.

-

Author of 14 trading books translated worldwide.

-

Winner of the Charles H. Dow Award for original market research.

-

Creator of the RSI(2) and RSI(4) systems still used by institutional desks.

-

Founder of TradingMarkets and Connors Research, known for evidence-based strategy design.

Now, Connors applies that legacy to the AI era — teaching traders how to combine cognitive reasoning with machine intelligence to achieve hedge-fund-level alpha.

Start Your AI Trading Journey Today

For just $93.1, gain 1.37 GB of high-level instruction, workflows, and professional frameworks that merge trading intuition with artificial intelligence.

Within hours, you’ll know how to build an AI-powered trading system that finds real alpha while most of the market still relies on outdated methods.

👉Enroll now in AI For Traders: A Professional Manual for Hedge-Fund-Level Alpha by Laurence Connors — and start uncovering the cognitive advantage that defines the future of trading.

Reviews

There are no reviews yet.