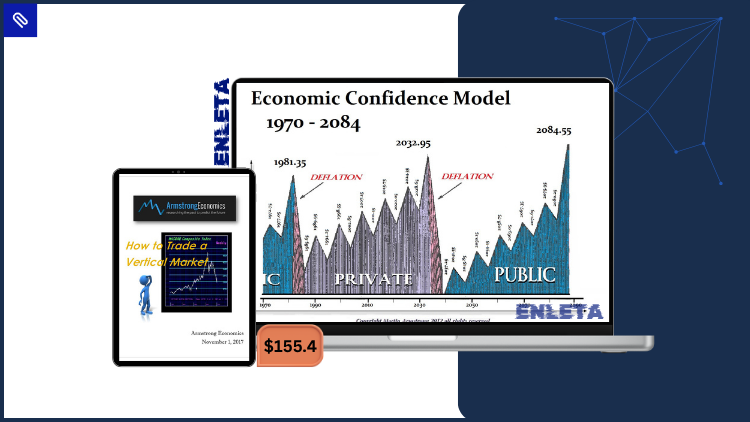

How to Trade a Vertical Market by Armstrong Economics – Mastering the Dynamics of Market Transitions

How to Trade a Vertical Market by Armstrong Economics is a specialized trading program designed to help traders understand, anticipate, and capitalize on the complex movements of vertical markets. Developed from decades of economic and technical research, this course provides a deep dive into the mechanics of market transitions — teaching how to recognize, interpret, and trade through periods of instability and rapid change.

How to Trade a Vertical Market Free Download – Includes Verified Content:

PDF Sample – How-to-Trade-a-Vertical-Market-Final-V2-1_sample, watch here:

About This Course

Vertical markets differ from traditional markets in their extreme behaviors — rapid rises, sudden declines, and brief moments of deceptive calm. The Armstrong methodology offers practical frameworks for managing these dynamics, helping traders transform volatility into opportunity.

Participants will explore the unique concepts of phase transitions (moments of radical change in market structure) and plateau moves (periods of false stability preceding major shifts). Through these principles, traders will gain the ability to navigate turbulence with clarity and precision, mastering one of the most powerful skill sets in modern financial analysis.

Why It Matters

In today’s fast-changing economic environment, traditional trading models often fail to capture the speed and intensity of vertical market movements. From global economic disruptions to shifts in monetary policy, traders face markets that move faster and less predictably than ever before.

The How to Trade a Vertical Market course matters because it provides a strategic edge in volatile conditions. By understanding how markets evolve through distinct vertical phases, traders can reduce emotional decision-making and strengthen their ability to respond to sudden price movements.

Armstrong Economics emphasizes that the key to consistent profitability lies in adaptability. Instead of fighting market changes, traders learn to identify their structure and align their strategies accordingly. This course empowers participants to:

-

Recognize when markets are entering a new vertical phase.

-

Adjust risk parameters dynamically.

-

Use technical and sentiment indicators synergistically.

-

Make data-driven decisions in alignment with broader economic trends.

In essence, it’s not just about reacting to market changes — it’s about anticipating them with foresight and precision.

Key Benefits of Joining the Course

-

Understand Vertical Market Behavior: Grasp the underlying principles of phase transitions and plateau moves that define modern markets.

-

Learn Advanced Risk Management: Discover how to protect capital while maximizing exposure to profitable movements.

-

Improve Analytical Precision: Combine technical analysis, sentiment tools, and economic insight for well-rounded decision-making.

-

Develop a Long-Term Trading Framework: Create strategies that remain effective across changing market conditions.

-

Trade with Confidence: Learn to recognize false signals, avoid emotional pitfalls, and trust data-driven analysis.

-

Apply Economic Context: Gain insight into how global economic events shape vertical market trends.

-

Enhance Forecasting Skills: Use cyclical models and scenario planning to anticipate potential market outcomes.

This course bridges the gap between theory and practice — providing actionable frameworks that traders can immediately apply to real-world markets.

Skills and Knowledge You Will Gain

1. Understanding Vertical Market Structures

-

Learn to distinguish between traditional and vertical market dynamics.

-

Identify the signals of phase transitions, where the market shifts direction or volatility spikes.

-

Recognize plateau moves as deceptive calm periods before major shifts.

2. Advanced Analytical Techniques

-

Apply multi-timeframe analysis to detect emerging divergences.

-

Integrate technical tools such as Fibonacci retracements, volatility bands, and trend indicators.

-

Utilize sentiment analysis to gauge market psychology before price changes occur.

3. Strategic Stop Placement and Position Management

-

Master the art of setting intelligent stop losses that balance safety and flexibility.

-

Learn to adjust stops dynamically as conditions evolve.

-

Develop precision in managing open positions across unpredictable environments.

4. Integrating Economic Context into Trading Decisions

-

Understand how monetary policy, inflation cycles, and geopolitical shifts influence vertical markets.

-

Examine historical examples of vertical transitions, such as post-crisis recoveries or speculative bubbles.

-

Develop adaptive models that align with economic data releases and macroeconomic trends.

5. Adaptive and Scenario-Based Thinking

-

Craft trading scenarios that anticipate multiple potential outcomes.

-

Prepare contingency strategies for unexpected volatility.

-

Learn how to shift from reactive to proactive trading through systematic planning.

6. Risk and Reward Optimization

-

Quantify potential profit and risk through data modeling.

-

Apply portfolio diversification strategies suited to volatile environments.

-

Manage psychological discipline and emotional regulation under stress.

By the end of this course, participants will not only understand how to read the language of vertical markets but will possess the frameworks to thrive within them — even during periods of uncertainty.

Who This Course Is Designed For

-

Professional Traders and Investors: Those seeking advanced strategies for navigating volatile, high-risk environments.

-

Financial Analysts and Economists: Professionals aiming to enhance their understanding of market cycles and transitions.

-

Portfolio Managers: Individuals responsible for protecting and growing client capital in unpredictable markets.

-

Intermediate to Advanced Traders: Those already familiar with technical analysis who want to refine their edge.

-

Students of Economic Theory: Learners who wish to apply macroeconomic principles directly to trading decisions.

-

Institutional and Retail Investors: Anyone committed to improving decision-making under high volatility conditions.

If you’re determined to master the relationship between market movement and economic momentum, this course provides the roadmap.

Meet Your Instructor

Martin A. Armstrong, founder of Armstrong Economics, is an internationally recognized economist, forecaster, and creator of the Economic Confidence Model. With decades of experience advising governments, institutions, and private investors, Armstrong’s work bridges the gap between economic theory and real-world application.

His proprietary models — built on cyclical and capital flow analysis — have consistently predicted major turning points in global markets. In this course, Armstrong distills his deep understanding of vertical market structures into actionable guidance, revealing how traders can align with the rhythm of global capital movement rather than resist it.

Armstrong’s teaching philosophy focuses on clarity, evidence, and strategy. Through How to Trade a Vertical Market, he offers traders not just insights, but a comprehensive methodology for mastering market behavior across all cycles of expansion and contraction.

Final Thoughts

The How to Trade a Vertical Market by Armstrong Economics course offers traders a rare opportunity to elevate their craft. In a world where financial markets evolve faster than ever, those who can interpret vertical transitions hold a decisive advantage.

This course empowers participants to move beyond guesswork — to understand how markets behave, why they shift, and how to act when others hesitate. By internalizing Armstrong’s principles of phase transitions and plateau moves, traders can decode the rhythm of market energy and transform volatility into profitability.

Incorporating both technical and economic perspectives, the program delivers a 360° approach to trading mastery — ensuring participants are equipped to succeed in every phase of the market cycle.

👉 Enroll today, Start Learning, and Get Certified in How to Trade a Vertical Market to gain the strategic edge you need to trade with precision, confidence, and foresight.

Reviews

There are no reviews yet.