🧭 Structuring Precision Trades with ICT – Entry & Check List by Finastic | Instant Download!

At $15.4 for a lightweight 32.6 MB trading guide, ICT – Entry & Check List by Finastic is built for traders who want to remove guesswork and execute trades using Institutional (ICT) Smart Money Concepts with structure and clarity.

Instead of reacting emotionally to price movement, this guide introduces a checklist-driven approach that enforces discipline before execution. Each trade is framed around liquidity, structure, and institutional behavior—helping traders align with how large players actually move the market rather than chasing short-term noise.

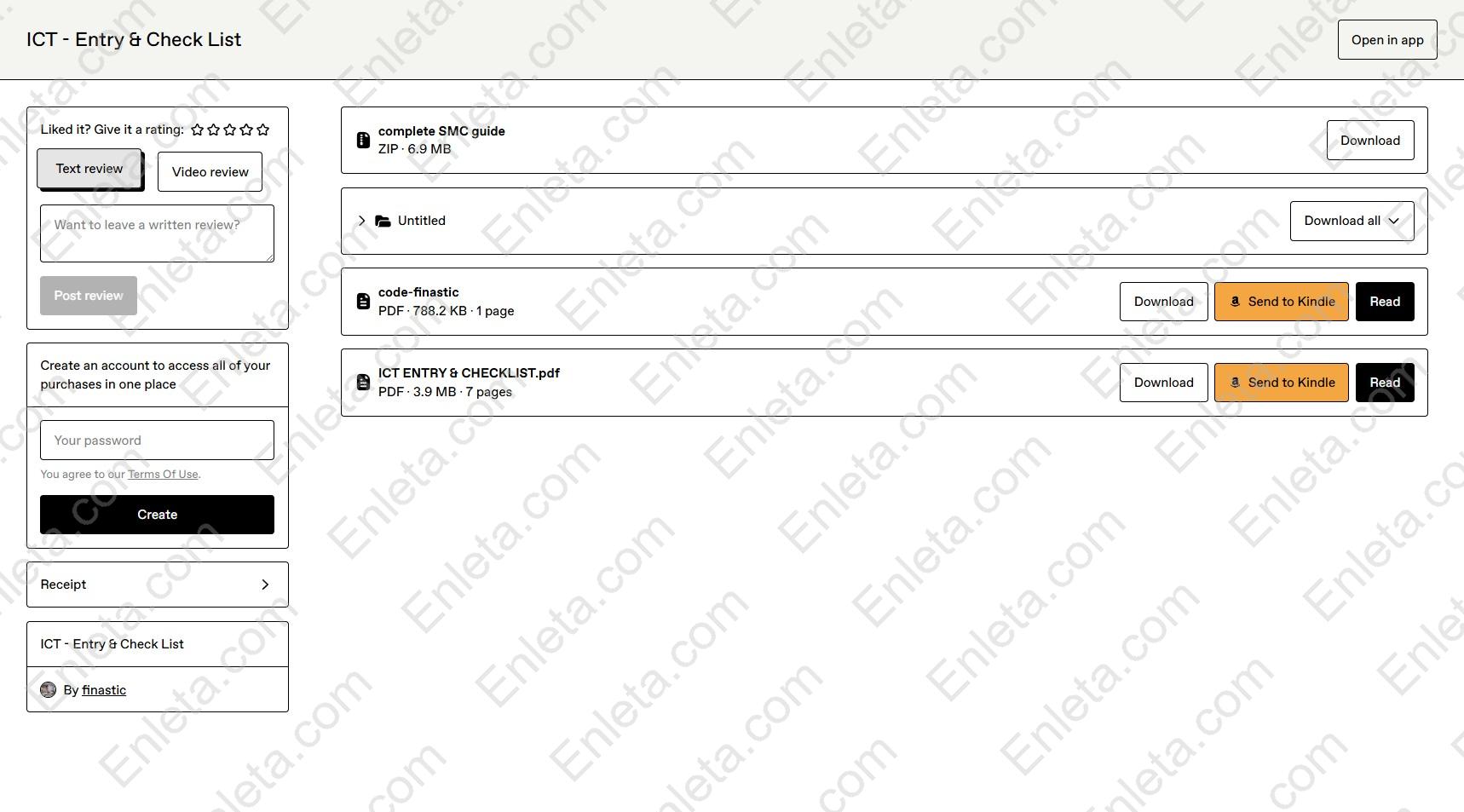

💼Free Download ICT – Entry & Check List | Verified High-Quality Content Included

Get instant access to our official, verified materials — designed to deliver trusted, professional content you can use right away.

✅ICT – Entry & Check List by Finastic | Verified Proof of Content Quality:

Explore verified credentials and quality assurance details confirming the authenticity and accuracy of the material.

📄 Preview the Free PDF Sample – ICT ENTRY _ CHECKLIST_sample:

View a high-resolution PDF excerpt to check the structure, design, and depth of information before downloading the complete file.

🧠 How Institutions Create Opportunities Before Retail Sees Them

Markets rarely move randomly. Institutional players engineer liquidity first, then deliver expansion once enough orders are absorbed.

This guide focuses on helping you recognize those mechanics in real time, so you can anticipate movement instead of reacting after it happens. By understanding how smart money builds positions, traders gain context that dramatically improves timing and patience.

You’ll learn to interpret:

-

Liquidity grabs where retail traders are trapped

-

Breaks of structure (BOS) that signal real directional intent

-

Market inefficiencies institutions leave behind

-

High-timeframe points of interest (HTF POI)

When these elements align, trades stop feeling forced and start feeling planned.

🧩 The Core Smart Money Components Inside the Checklist

Rather than treating ICT concepts as isolated ideas, Finastic organizes them into a unified execution framework. Each component plays a defined role within the checklist so traders know why it matters—not just what it is.

This structure helps prevent cherry-picking signals and instead encourages full confirmation before entry.

Key components include:

-

Liquidity grab identification to expose stop-hunts

-

Break of structure confirmation for directional bias

-

Fair value gaps (FVG) for precision entries

-

Order blocks as institutional footprints

-

Optimal Trade Entry (OTE) using Fibonacci 0.62–0.79

Together, these elements create a repeatable decision-making process.

📐 Five Entry Architectures That Remove Guesswork

Each entry model is designed to solve a specific market condition while maintaining the same institutional logic. Traders can select the model that fits current structure instead of forcing one setup everywhere.

🔹 Model 1 – HTF POI + BOS + FVG

A foundational smart money entry focusing on structure and imbalance, ideal for traders new to ICT execution.

🔹 Model 2 – HTF POI + BOS + IDM + FVG

Introduces internal liquidity to refine timing and filter weaker setups.

🔹 Model 3 – HTF POI + BOS + FVG + OTE

Combines imbalance with Fibonacci precision for sniper-style entries.

🔹 Model 4 – HTF POI + BOS + IDM + FVG + OTE

An advanced setup designed for traders seeking maximum confluence and control.

🔹 Model 5 – Box Setup

Built for consolidation environments where volatility expansion is imminent.

Across all models, the logic remains consistent: liquidity first, structure second, execution last.

🎯 Why a Checklist-Based Approach Improves Consistency

Most traders fail not because of poor strategies, but because they abandon rules under pressure. A checklist removes discretion at the most emotional moments.

By forcing validation before entry, traders reduce impulsive behavior and improve long-term expectancy.

Benefits include:

-

Fewer low-quality trades

-

More consistent execution

-

Improved risk-to-reward discipline

-

Stronger confidence during drawdowns

👉 If overtrading or hesitation has been holding you back, a checklist-based system fundamentally changes how you interact with the market.

👥 Who ICT – Entry & Check List by Finastic Fits Best

This guide is designed for traders who already understand basic charting but want institutional-level structure. It bridges the gap between theory and real execution.

It works especially well for:

-

Forex traders studying ICT concepts

-

Traders overwhelmed by indicator-based systems

-

Smart money students lacking entry clarity

-

Multi-market traders needing consistency

-

Traders seeking high-probability setups

Because the logic is universal, it adapts easily across assets and timeframes.

⚖️ How This Differs from Generic ICT Content

Many ICT resources explain concepts without showing how to act on them live. This guide is different because it converts theory into execution logic.

Instead of vague rules, traders receive a decision framework that can be followed under pressure.

Key differences include:

-

Checklist-driven execution

-

Emphasis on confirmation over prediction

-

Focus on repeatability, not complexity

-

Clear alignment with institutional behavior

It’s meant to sit next to your charts—not just in your library.

🧑🏫 About Finastic’s Trading Framework

Finastic’s approach focuses on simplification without dilution. Institutional concepts are presented clearly, without unnecessary jargon or over-optimization.

The checklist format mirrors how professional traders think—validate conditions first, manage risk second, execute last. This mindset shift is often what separates consistency from randomness.

This visual trading guide explains ICT smart money entries with order blocks, fibonacci otes, and structured confirmations

🧾 Executing with Confidence Using ICT – Entry & Check List by Finastic

At $15.4 for 32.6 MB of focused trading material, ICT – Entry & Check List by Finastic delivers a practical framework for trading with institutional logic.

By turning ICT concepts into structured entry models, this guide helps traders replace hesitation and guesswork with clarity and confidence—one checklist at a time.

👉 Download the checklist and start executing trades with institutional structure.

Reviews

There are no reviews yet.