Kill Zones Mastery – Trade When Smart Money Moves by Finastic – Instant Download!

Kill Zones Mastery – Trade When Smart Money Moves is a specialized training program intended for traders who wish to align their executions with institutional activity. The course teaches how to identify “kill zones”—specific time windows during trading sessions when volume, volatility, and liquidity converge—and how to trade them using smart money concepts such as liquidity sweeps, displacement, order blocks, and fair value gaps. Instead of relying solely on indicator signals, you learn to read price action in high-impact moments where institutional players tend to operate.

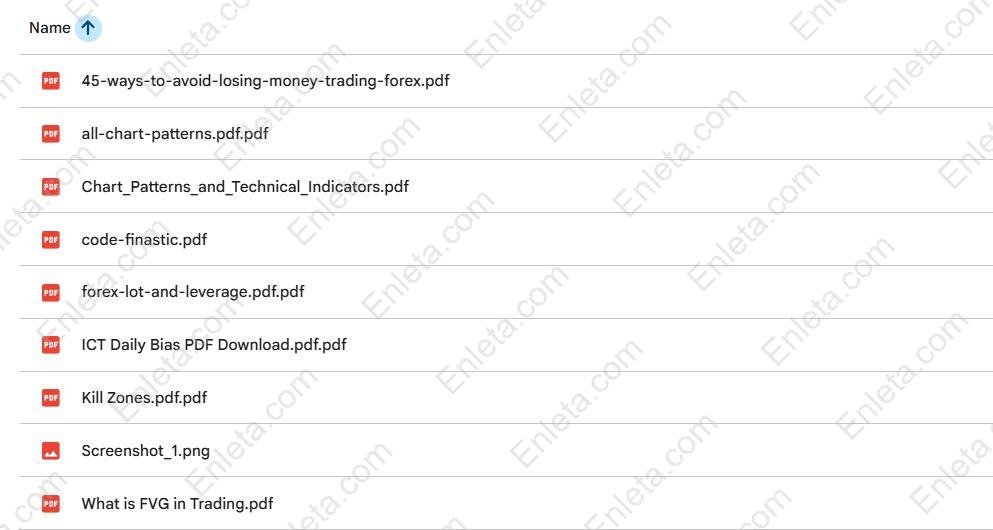

Kill Zones Mastery – Trade When Smart Money Moves by Finastic Free Download – Includes Verified Content:

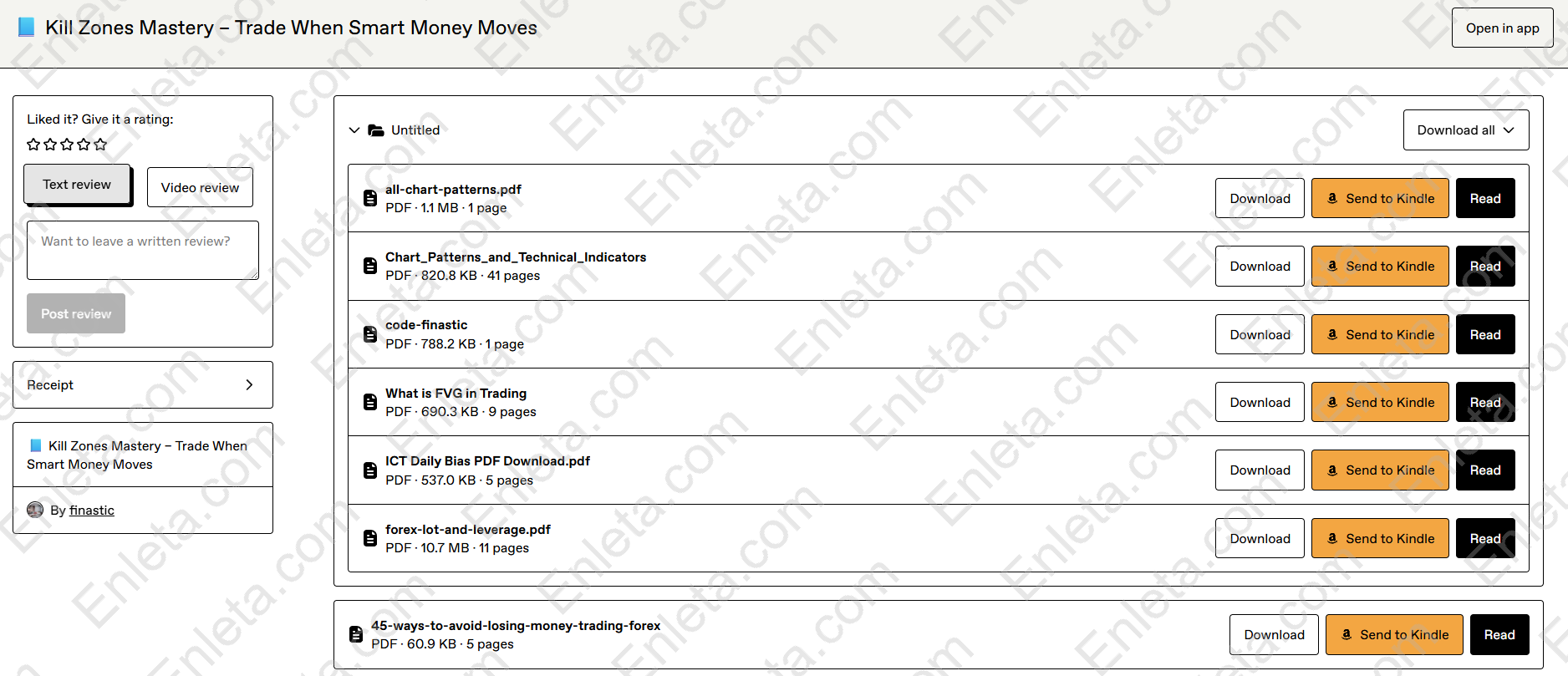

Kill Zones Mastery – Trade When Smart Money Moves Free Download, Watch content proof here:

PDF Sample – Kill Zones Mastery – Trade When Smart Money Moves, watch here:

Kill Zones Mastery – Trade When Smart Money Moves – Overview this course

The curriculum includes detailed video modules, live examples, backtesting procedures, charting walkthroughs, and trade templates. Students are guided to apply the methods across multiple market instruments—forex, indices, commodities, or equities—so the lessons are broadly applicable. Through repeated practice within the kill zones, you build pattern recognition for when price is being manipulated, when true directional intention is revealed, and how to filter noise.

By the end, participants should no longer wait passively for trades to appear—but proactively locate the windows when price is most likely to move with power.

Why should you choose this course?

-

Focus on high-probability times

Rather than trading at random times, this course trains you to concentrate your efforts during kill zones—when smart money tends to move. This efficiency reduces drawdowns and increases trade quality. -

Institutional alignment, not contrarian guessing

Many retail strategies try to predict reversals or breakouts blindly. This system teaches you to link your decisions to institutional liquidity mechanics, giving you a more grounded edge. -

Concepts over indicators

Instead of stacking dozens of lagging indicators, this training emphasizes price structure, liquidity sweeps, fair value gaps, and order block zones that reflect actual market actions. -

Cross-instrument adaptability

Whether you trade forex, indices, futures, or cryptos, the methods translate—because the logic is rooted in how institutions move money, not in a specific market context. -

Structured learning and feedback loops

The course offers practice drills, pattern recognition routines, and case studies so your skill improves incrementally rather than by trial and error. -

Risk control integrated into methodology

Every entry method taught includes stop placement principles tied to liquidity zones, minimizing arbitrary risk and enforcing discipline.

If your goal is to stop trading random setups and instead trade when price is biased and active, Kill Zones Mastery offers you a disciplined, concept-driven path.

What You’ll Learn

By completing Kill Zones Mastery – Trade When Smart Money Moves, you will learn:

-

The definition and significance of kill zones, and when in a session institutionally driven activity is most likely.

-

How to mark session highs, session lows, previous day highs/lows, and swing levels as context for kill zone setup.

-

Liquidity mechanics: how price hunts stop orders, sweeps liquidity, and triggers institutional participation.

-

Displacement and fair value gaps (FVG): identifying the initial move and how to exploit the unfilled zone left behind.

-

Order blocks and structure shifts: how to detect when price breaks market structure and where smart money might reenter.

-

Entry timing: return to FVG or order block zones after displacement, filtered by kill zone timing.

-

Stop placement: how to place stops relative to sweep extremes, wick boundaries, and structure edges.

-

Targeting and exit rules: using subsequent liquidity zones, structural pivots, or measured moves.

-

Multi-timeframe confirmation: combining higher timeframe context with lower timeframe precision.

-

Backtesting process: how to validate kill zone setups historically and refine filters.

-

Pattern recognition drills: exposure to many kill zone setups so your internal radar improves.

-

Trade management rules: when to hold, scale, cut losses, or let winners run within institutional context.

-

Avoiding trap zones: filtering fake breakouts, overshoots, and manipulative price action.

-

Adapting to volatility regimes: how kill zone strategies differ in trending vs ranging markets.

-

Psychological discipline: sticking to methods, not forcing trades when conditions don’t align.

By the end of this program, you will not only recognize kill zone setups but trade them with clarity, discipline, and institutional logic rather than guessing.

Who Should Take This Course?

-

Traders who already know basic price action but lack timing discipline.

-

Intermediate traders who experience inconsistent results and want to improve probability.

-

Day traders or intraday scalpers seeking to refine when they take trades.

-

Swing or short-term traders wanting to overlay kill zone timing to filter entries.

-

Traders comfortable with chart reading but looking for advanced structure logic.

-

Anyone wanting to trade with institutional alignment rather than lagging indicator reliance.

If you prefer fully mechanical indicator systems and dislike discretionary judgment, this course may feel more conceptual than formulaic. But for traders who want to think like smart money, it is a highly potent path.

Conclusion

If you aim to move from random execution and inconsistent results to trading with clarity and edge, then Kill Zones Mastery – Trade When Smart Money Moves gives you the system. This course teaches when institutions move, how they manipulate liquidity, and how to position yourself alongside that movement—not against it. Through kill zone focus, structure reading, liquidity sweeps, and disciplined execution, you gain the tools to trade with higher confidence and reduced risk.

Kill Zones Mastery – Trade When Smart Money Moves is the anchor from which you transform your trading into a strategic, aligned practice.

👍Enroll now and learn to trade precisely when smart money moves—within the kill zones.

Reviews

There are no reviews yet.