Mastering The Overnight Trade – The Sleeper Hold by Drew Dosek

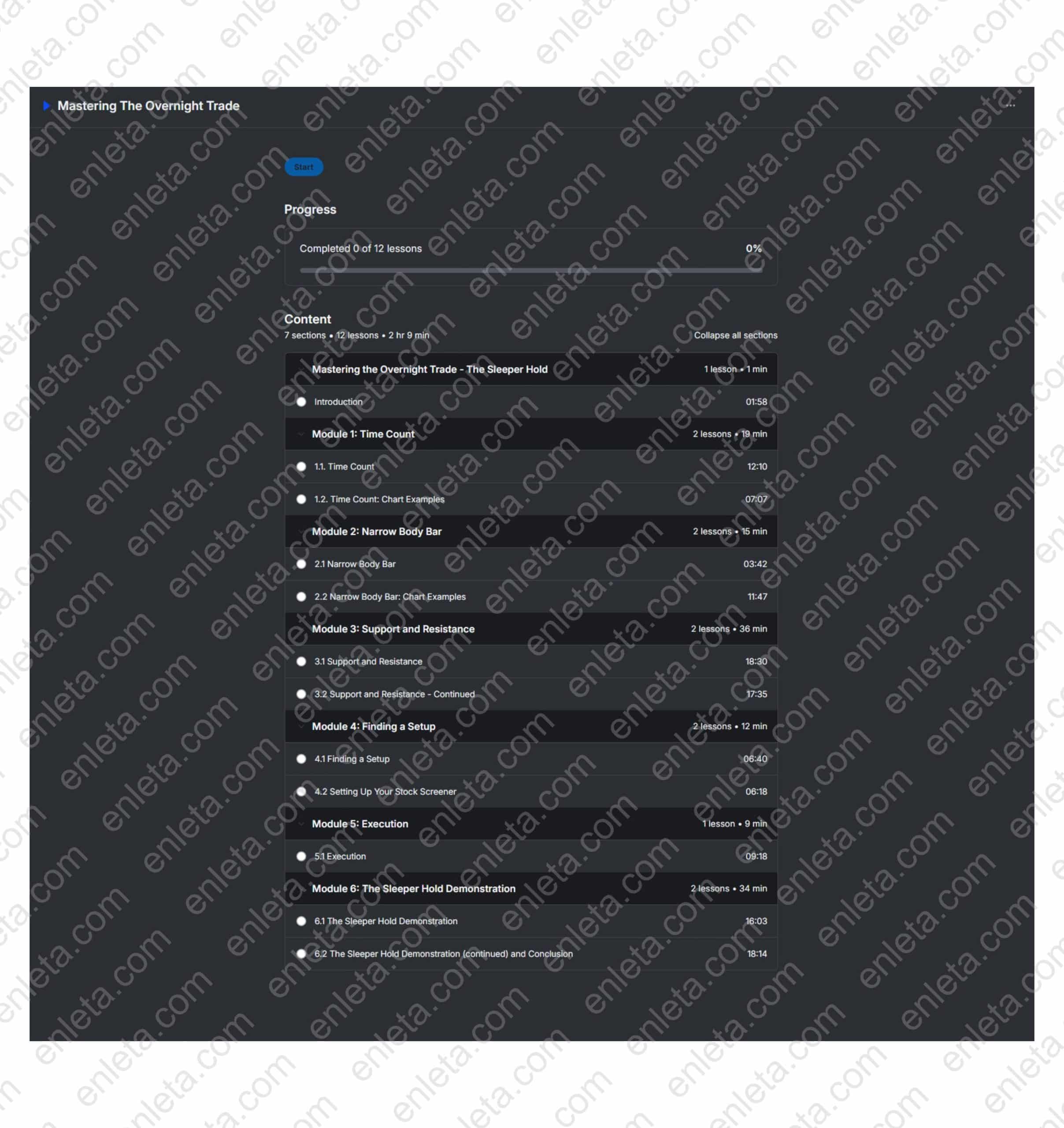

Mastering the Overnight Trade – The Sleeper Hold is a specialized strategy course from Verified Investing that teaches a three-factor, technically driven approach to capture high-probability moves between the close and the next day’s open. Instead of a grab-bag of indicators, the curriculum narrows your focus to a precise confluence: narrow-body bars (compression), time counts (timing windows), and key support/resistance (location). By learning to stack these three signals, traders aim to identify asymmetric, time-efficient setups that can be entered late in the session and exited on the following session’s liquidity burst. The product page frames this as a repeatable, rules-based framework explicitly designed for the “overnight edge,” not a generic day-trading recipe.

Mastering The Overnight Trade – The Sleeper Hold by Drew Dosek Free Download – Includes Verified Content:

Mastering The Overnight Trade – Free Download Video Sample:

Mastering The Overnight Trade, Watch content proof here:

Mastering The Overnight Trade – Overview this course

The program is led by Pro Trader Drew Dosek, a Verified Investing instructor with an active public presence across the platform’s shows and collections. On the courses hub and instructor profile, the Sleeper Hold method is highlighted with a runtime of approximately 2 hours 9 minutes, providing a compact but dense walkthrough of theory, setup recognition, and case studies.

Beyond the single method, the Verified Investing ecosystem gives learners context and reinforcement via live shows, trader profiles, and additional courses—useful for situational awareness when markets shift regime. The Sleeper Hold sits in that broader catalog of technical-analysis education, complementing swing, day, and crypto lessons under the same umbrella.

Why should you choose this course?

1) A crisp edge for limited screen time

Not everyone can sit through the full session. The Sleeper Hold is engineered for end-of-day decision making and next-morning exits, allowing professionals with day jobs—or traders who prefer concentrated execution—to participate without marathon screen hours. You’re taught to focus on specific compression bars, timing windows, and S/R zones that historically precede outsized moves into the next open.

2) A three-factor confluence that reduces false positives

Single-signal trades (e.g., “buy every inside bar”) often disappoint. This framework requires alignment of bar structure (narrow body), time counts (a codified timing element), and location (institutionally watched levels). The multi-filter design aims to cut noise and funnel attention to high-quality overnight candidates only.

3) Instructor access and proven platform

Verified Investing positions its instructors as active traders with public analysis. With Drew Dosek teaching and appearing on platform shows, students get a consistent voice and methodology across media, increasing comprehension and trust.

4) Compact runtime, dense signal

At ~2h09m, the course is short enough to finish in one sitting yet complete enough to implement immediately—ideal for traders who prefer execution over encyclopedic theory.

5) Ecosystem continuity

Should you want to broaden beyond overnight setups, the course nests within a suite of technical-analysis classes and live rooms under the same brand, so your learning curve remains coherent.

What You’ll Learn

1) The Sleeper Hold framework: three pillars of confluence

-

Narrow-body bars (compression): how to define and scan for genuine volatility contraction (vs. random small candles), why compression near inflection points tends to precede range expansion, and which bar contexts (inside bars, doji-like prints, micro-ranges) are most predictive into the next open.

-

Time counts (timing): the logic of counting bars or sessions to anticipate when a move is statistically “due,” how to avoid forcing trades outside the valid window, and how timing interacts with daily/weekly opening flows.

-

Support/Resistance (location): identifying key levels with multiple touches, gap fills, anchored VWAP interactions, or prior highs/lows; distinguishing reaction levels from breakout levels to plan targets and invalidation.

2) Pattern recognition with institutional context

Learn to overlay the three factors on liquidity events: earnings gaps, macro prints, or sector catalysts. The course breaks down how opening auctions absorb overnight inventory and why price often “seeks” the nearest obvious level before resolving. (This practical context is emphasized across the product copy and Verified Investing’s broader technical-analysis stance.)

3) Trade construction for the overnight session

-

Entry triggers: EOD confirmations (e.g., break of micro-range high/low), limit vs. stop orders for the next open, and when to pre-stage orders outside regular hours.

-

Risk definition: setting a tight invalidation beneath/above structural levels, using ATR-scaled stops to accommodate opening volatility, and cutting early if time-count invalidates.

-

Sizing: position sizing to keep max loss per trade constant given gap risk; handling correlated baskets (e.g., semis, big tech) to avoid stealth over-exposure.

4) Gap physics & morning execution

Why certain narrow-range compressions near levels tend to gap and run, how to avoid trap opens (gap-and-crap, gap-fill reversals), and a decision tree for exits: take profits at pre-mapped levels vs. hold partial for a drive into the opening range expansion.

5) Scanning and watchlist building

Practical filters to prioritize A-setups: narrow-range rankers, relative volume, proximity to S/R, and time-count alignment. You’ll build a one-page nightly checklist that takes minutes to run.

6) Case studies & chart breakdowns

Annotated examples show the before/after of Sleeper Hold trades, illustrating the three-factor logic, the exact invalidation, and how profit was realized. These examples compress learning cycles and provide templates for your own playbook.

7) Risk governance for an overnight edge

-

Event calendar triage: when to stand down (major macro prints, earnings clusters) and when to size down.

-

Portfolio heat: cap the number of simultaneous overnight positions, especially if they share a beta driver (e.g., NDX).

-

Execution logs: maintain a post-open scorecard (fill quality, slippage, adherence to plan) to tighten your process each week.

8) Tools & workflows

The method is platform-agnostic. You’ll see how to replicate the process on common charting packages and brokers, using alerts, drawing tools, and end-of-day scans. The focus is on simplicity: fewer indicators, more structure.

Who Should Take This Course?

Time-constrained professionals seeking evening prep + morning execution. If your schedule only allows you to analyze after work and act around the open, this strategy is structurally aligned with your day.

Swing and day traders who want a rules-based overnight edge rather than intraday scalping. The three-factor confluence helps filter noise and concentrate risk into fewer, better bets.

Intermediate technicians familiar with basic S/R who want to add timing and compression to their toolkit. If you already map levels but struggle with when to act, the time-count layer is the key unlock.

Students of the Verified Investing ecosystem who prefer a compact, actionable course they can finish in one sitting and start testing immediately. The short runtime and focused scope are intentional.

Risk-aware traders who understand that overnight gaps cut both ways and value a method that spells out invalidation, position heat limits, and event filters upfront.

Practical applications you can implement this week

-

Build a nightly scan for the top 20 tickers (or your niche list): flag narrow-body bars within X% of a mapped level; add a column for time-count eligibility (e.g., bar 8/9 in your scheme).

-

Map two exits before entry: an initial “first trouble area” (prior pivot or anchored VWAP) and a stretch target (measured move or multi-touch level).

-

Preset your risk: fix a max-R per overnight position; cap portfolio overnight heat (e.g., ≤ 3 concurrent positions unless uncorrelated).

-

Run a 10-trade pilot: log setup quality, gap behavior, slippage, R multiple, and adherence to the three-factor rules. Only scale once expectancy is positive.

-

Create a morning checklist: confirm fills, re-validate levels on the opening range, execute partials at pre-planned levels, and exit entirely on time-count invalidation or failure to hold the mapped location.

How the course supports a “natural flow” and SEO-friendly learning experience

The Sleeper Hold methodology embodies the same traits that search engines reward in high-quality content: clarity, topical depth, and user outcome focus. Instead of vague “edge” claims, the course gives you a tight problem definition (overnight opportunity), a structured solution (three-factor confluence), and a measurement plan (risk governance, logging, expectancy). That coherence makes it easier to internalize—and to execute consistently under uncertainty.

Conclusion

Overnight opportunity is real—but only when you combine compression, timing, and location into a disciplined, risk-defined plan. Mastering the Overnight Trade – The Sleeper Hold distills that plan into a compact, implement-today framework: learn to spot narrow-body bar compressions near high-value S/R, add time-count confirmation, stage entries at the end of the session, and manage exits through the opening range with pre-planned levels and invalidations. With Drew Dosek as instructor and the Verified Investing ecosystem for context, you get a focused, two-hour training that favors precision over noise—ideal for traders who want fewer, better overnight bets and a playbook they can refine across market regimes. If you’re ready to convert end-of-day prep into next-day follow-through, Mastering the Overnight Trade – The Sleeper Hold offers a disciplined, technically grounded path to do it.

👍Own the edge between the close and the open—enroll in Mastering the Overnight Trade – The Sleeper Hold and start executing a precise, three-factor overnight strategy this week.

👉Or you can try to find more options here

Reviews

There are no reviews yet.