Opening Rush by Sami Abusaad – Instant Download!

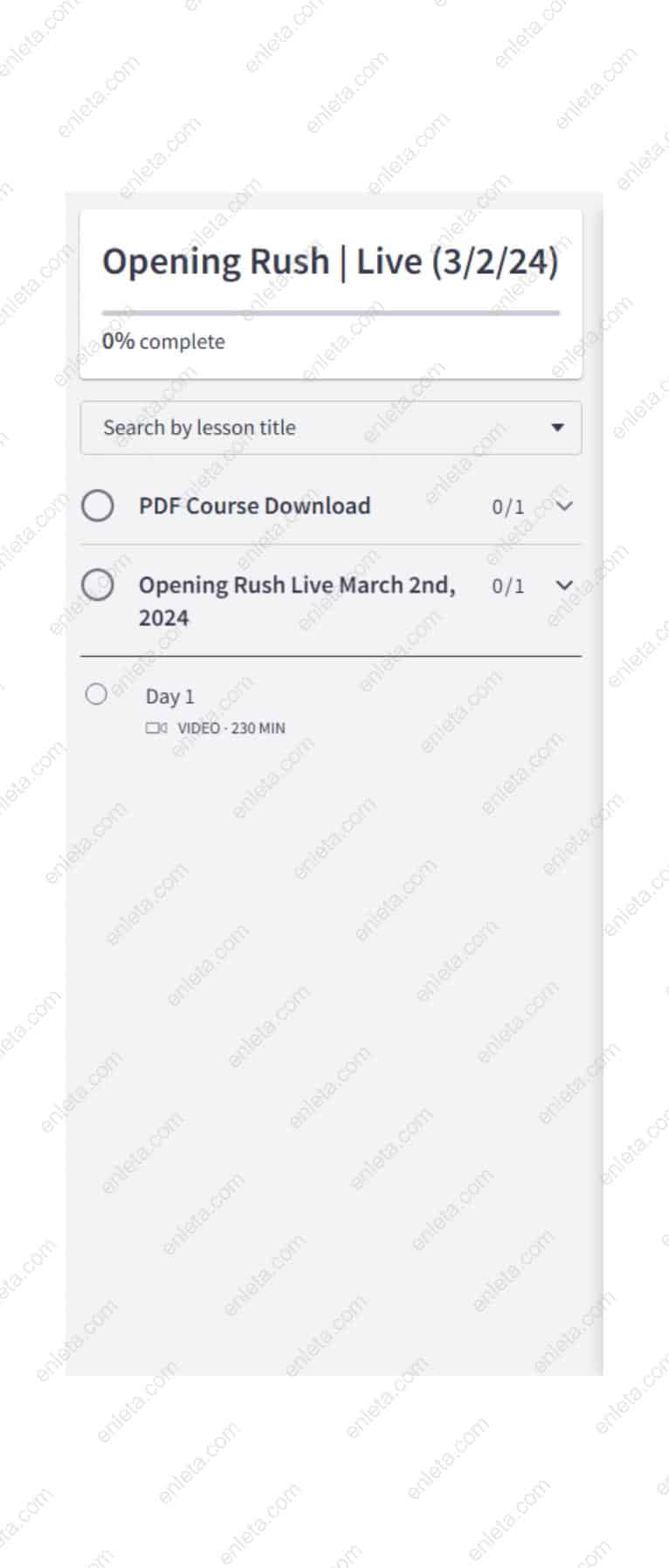

The Opening Rush Home Study is a focused training program that teaches the strategy of trading the opening gap in intraday markets, developed by Sami Abusaad via T3 Live. The course includes over 3 hours of on-demand video lessons, along with a comprehensive 106-page course guide that serves as your desktop reference during live trading.

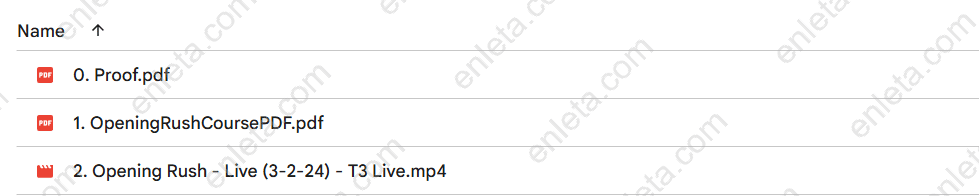

Opening Rush by Sami Abusaad Free Download – Includes Verified Content:

Opening Rush by Sami Abusaad Free Download, Watch content proof here:

PDF Sample – Opening Rush by Sami Abusaad, watch here:

Opening Rush by Sami Abusaad – Overview This Course

The curriculum is designed to help you understand how to identify, rate, and trade gaps at market open—one of the most active and opportunity-rich periods of the trading day. You’ll learn a methodical approach to filtering which gaps are worth trading, when to enter, how to size positions, and how to manage risk. As a bonus, the program also includes strategies for trading afternoon gap moves (the “Bleed Pattern”).

Because it’s a home study format, you can learn at your own pace, revisit content, and apply lessons gradually. The structure aims to help you build confidence, reduce indecision, and sharpen your decision-making ability in early market conditions.

Why Should You Choose This Course?

-

Specialized method: Many courses teach general swing or trend strategies. This one zeroes in on gap strategies at the market open—an environment of high volatility and liquidity, which often offers sharper opportunities.

-

Simplicity with clarity: The system is distilled into a 5-point gap rating framework and 5 entry patterns, reducing guesswork and helping you focus on setups that historically matter.

-

High leverage of time: Because the open sees the most volume and volatility, a few good trades early in the session can generate outsized gains. This course is built to help you take advantage of that window.

-

Practical structure: The program includes clear, actionable rules and screening techniques so you don’t chase random setups. You’ll learn which gaps are significant and which are noise.

-

Bonus pattern insight: Beyond just opening gaps, the course gives you an afternoon gap method (Bleed Pattern), so you can potentially exploit moves later in the session.

-

Risk awareness: The training places emphasis on filtering bad trades, managing losses, and avoiding over-exposure—critical in fast markets.

-

Reference materials: With a detailed course guide and checklist, you have a tangible reference during live trading, helping you stay disciplined and consistent.

What You’ll Learn

Here’s a breakdown of the core topics and skills you will master in the Opening Rush Home Study:

1. Fundamentals of Gap Trading

-

What defines an “opening gap” and how to interpret it

-

Why markets open with high liquidity and volatility

-

The mechanics of gap formation: overnight news, premarket trading, order flow

2. Gap Rating System

-

How to rate gaps using a 5-point checklist to filter setups

-

Gap size analysis—distinguishing meaningful gaps from trivial ones

-

Criteria to eliminate weak gaps automatically

3. Entry Patterns

-

The 5 entry patterns you can use for opening gap trades

-

How to choose which entry pattern suits a given gap context

-

Trade trigger rules and how to refine your timing

4. Scanning & Setup Selection

-

How to quickly scan for potential gap trades before market open

-

Use of scanners or premarket filtering methods

-

Which premarket or afterhours signals to pay attention to

5. Risk & Position Management

-

How much capital to risk per trade

-

Scaling, partial exits, and trade management techniques

-

Using stops and mental frameworks to guard against large drawdowns

6. Trading Psychology in the Open

-

Handling fear, hesitation, FOMO (fear of missing out)

-

Clarity under pressure: sticking to your plan even amid volatility

-

Avoiding impulsive trades and overtrading

7. The Bleed Pattern: Afternoon Gaps

-

How to spot and trade gaps later in the day when momentum fades

-

Adjusting the gap method rules for afternoon conditions

-

Trade triggers and risk management for this variant

8. Real-World Application

-

Example trades walked through step by step

-

Reviewing missed trades, mistakes, and decision points

-

How to adapt the method to your own risk tolerance and capital

By completing the course and applying the system, you’ll gain the ability to make informed decisions on opening gaps, spot high probability setups, control risk, and avoid emotional traps.

Who Should Take This Course?

This course is ideal for:

-

Day traders who want a structured, rules-based system focused on the opening period

-

Traders with some experience in charting, order flow, or technical setups who want to refine a niche edge

-

Individuals comfortable operating in fast markets and willing to manage risk carefully

-

People looking for a repeatable strategy rather than chasing random signals

-

Those who prefer a compact, focused method over a sprawling, generalist trading system

This course is less suitable for:

-

Total beginners to trading—some familiarity with charts, volatility, and trade execution is beneficial

-

Investors only interested in long-term, multi-day strategies (this is focused intraday)

-

Those unwilling to adopt discipline, backtesting, or systematic rules

Conclusion

The Opening Rush Home Study gives you a scalable, methodical approach to trading opening gaps with clarity, confidence, and risk control. With over 3 hours of training, a rich course guide, and a bonus method for afternoon gap moves, it delivers a focused blueprint to master one of the most active parts of the trading day. If you’re serious about harnessing intraday volatility strategically, this program provides the framework you need.

👍Enroll now and start trading with confidence—dominate the open and capture opportunity with precision.

Reviews

There are no reviews yet.