Part Deux Advanced Training 2022 by Watch Trading Academy – Digital Download!

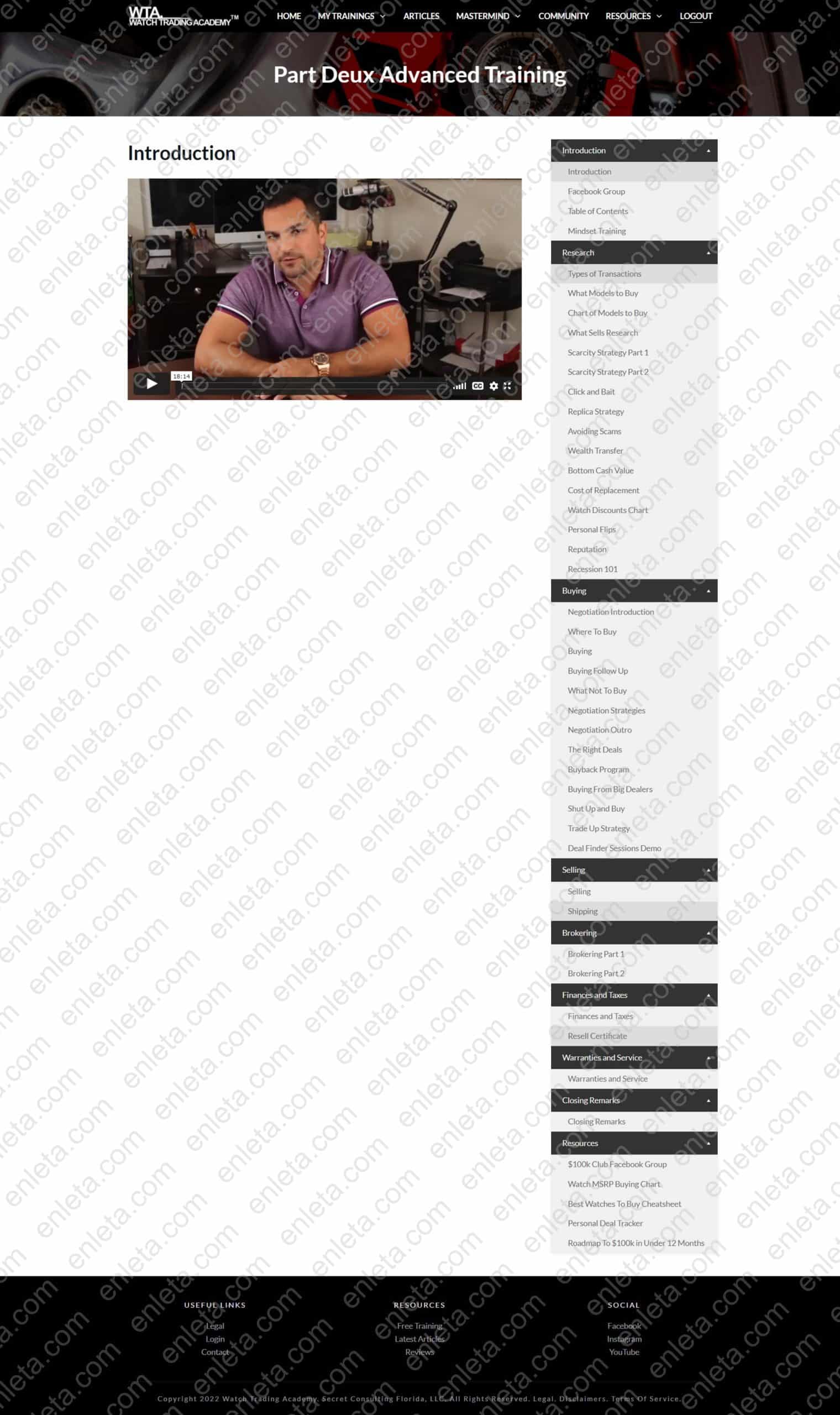

Watch Trading Academy: Part Deux – Advanced Training (2022) is a high-level program designed to take watch flipping from side hustle to a repeatable, scalable business. Positioned as an extension of the core Watch Trading Academy curriculum, Part Deux focuses on the operations, strategy, and economics of running a profitable watch business rather than simply teaching single flips. The official description emphasizes that it goes “much more in-depth” on building a watch operation, inventory and cash-flow systems, investment strategies, and even taxes—framing the training as a serious commitment for traders who want to professionalize.

Part Deux Advanced Training 2022 by Watch Trading Academy Free Download – Includes Verified Content:

Part Deux Advanced Training 2022 – Free Download Video Sample:

Part Deux Advanced Training 2022 Free Download, Watch content proof here:

Part Deux Advanced Training 2022 – Overview this course

A key promise of the Part Deux offer is over 10 hours of new HD training that codifies advanced techniques and case studies—complete with the “real secret” to securing 20%+ margins consistently and a “scarcity buy” approach credited with outsized profits on select deals. Learners get access to private deal breakdowns and client-service frameworks to increase repeat business with higher-end buyers. These elements distinguish Part Deux from entry-level watch courses by centering on deal quality, margin control, and durable client relationships.

This advanced tier also acts as the gateway to the Watch Trading Academy’s upper programs (e.g., coaching focused on scaling beyond six figures), signaling that Part Deux is the platform’s professional track for traders ready to specialize in brokering, buying at BCV (bottom cash value), and serving retail clients who value convenience over shaving fees.

Why should you choose this course?

Built for margin, not motion. Many resellers chase volume with thin spreads. Part Deux argues for the inverse—fewer deals with bigger margins—and teaches how to engineer that outcome using targeted sourcing, client positioning, and selective specialization. The materials emphasize the discipline of hitting a minimum 20% margin as a design constraint, not a lucky accident.

A complete operating system. Rather than isolated tricks, you learn how to operate: set up cash-flow rules, manage inventory holding risk, broker rather than over-inventory, and make tax-aware choices that preserve take-home profit. The program’s own page highlights expanded guidance on business setup, cash flow and inventory, and tax considerations—topics that directly affect net ROI yet are usually missing from hobbyist tutorials.

Case-study transparency. Access to personal flip breakdowns and decision rationales reduces the guesswork around pricing ladders, timing exits, and handling outliers. You don’t just see screenshots—you study why certain watches, at specific references, became asymmetric opportunities (e.g., a scarcity-buy strategy).

Professional progression path. If your goal is to enter higher-ticket brokering, private-client sourcing, or concierge placements, Part Deux is positioned as the prerequisite for advanced coaching tiers. That connective tissue matters if you plan to scale beyond $100k in annual profit with repeatable SOPs, brokering ethics, and client experience playbooks.

Credibility and ecosystem. Watch Trading Academy is a dedicated brand/platform with a content hub, community, and public presence (site, social, YouTube) built around trading watches for profit, not generic reselling. That ecosystem provides reinforcement, examples, and ongoing ideas beyond a static video dump.

What You’ll Learn

1) Margin Engineering & Deal Architecture

-

How to source at or below BCV and structure deals for built-in spread from day one.

-

Using “scarcity buys”—leveraging seasonal demand and short-supply references—to achieve outsized, non-linear profits on fewer flips.

-

Designing margin floors (20%+) and walk-away rules; knowing when to broker vs. take inventory risk.

2) Cash-Flow, Inventory, and Tax Fundamentals

-

Establishing cash-conversion cycles that keep capital rotating and inventory days low.

-

Calculating total landed cost (purchase, service/parts, insurance, shipping, platform fees).

-

Basic tax workflows for a trading operation: tracking basis, documenting expenses, and planning for quarterly estimates (jurisdiction-dependent; the course speaks to operating and tax awareness at a high level).

3) Client Acquisition & Retention for High-End Buyers

-

Building a bespoke client experience that increases repeat purchase velocity and referrals, including white-glove sourcing, unboxing standards, and proactive service intervals.

-

Creating a pipeline of ready buyers for popular SKUs and a bench of collectors for fast exits on grail and hype pieces.

4) Brokering at Scale

-

How to broker when the spread justifies it: validating authenticity, managing escrow, setting expectations on timelines, and negotiating finder’s fees.

-

Policies for dealing with timewasters and tire-kickers while staying compliant with platform rules and payment protections.

5) Reference Selection & Timing

-

Reading demand cycles (releases, discontinuations, macro sentiment) and mapping them to references and configurations that move.

-

Deciding when to capture quick profit vs. hold for mean-reversion premiums; avoiding dead stock that ties up capital.

6) Negotiation Playbooks & Counterparty Vetting

-

Scripts and heuristics for private sellers, wholesalers, and retailers; using proof-of-funds, trade references, and serial audits to reduce fraud exposure.

-

Knowing when to switch from price negotiation to value stacking (speed, convenience, trust) for client-retention margin.

7) Operational SOPs & Risk Management

-

Standardizing inspection, documentation, and photography so listings are trustworthy and defensible.

-

Shipping, insurance, and chain-of-custody SOPs to minimize claims and protect spreads; triaging returns and after-sale issues without nuking margin.

8) Case Studies & Real-World Walkthroughs

-

Deconstruction of personal flips not shown in the core course: where the deal came from, why the price was acceptable, how the exit was negotiated, and what went wrong/right.

-

Templates for repeat communication, watch lists, and “buyers-in-waiting” databases to accelerate exits.

Who Should Take This Course?

Serious part-time traders ready to go pro. If you’ve been flipping a handful of pieces with sub-10% margins and want to move to high-margin, lower-volume deals with predictable processes, the advanced content is aligned with that transition. The messaging around $100k/year outcomes, margin floors, and brokering indicates a focus on professionalization rather than hobbyist tinkering.

Entrepreneurs seeking a replicable luxury trading model. The course is pitched as an extension of the core program and explicitly covers business setup, tax awareness, and inventory management—making it suitable for founders who want a structured, SOP-driven approach instead of ad-hoc “quick flips.”

Brokers who want better clients and faster exits. If you already have access to deal flow but struggle to maintain spreads, Part Deux’s emphasis on bespoke client experience and case-study-driven positioning helps you raise perceived value and reduce nitpicking on price.

Collectors turning knowledge into income. Deep reference familiarity can translate into real profit when paired with operational discipline (inspection, documentation, shipping, after-sale). The advanced playbooks help transform a collector’s eye into a business.

Practical Applications and Use Cases

-

Designing a 90-day pipeline that schedules capital rotations, target references, and pre-sold buyer lists so that each watch has an exit route before acquisition.

-

Executing scarcity buys on constrained references (allocation pieces, seasonal spikes), then documenting comps and timelines to justify premium pricing to retail clients.

-

BCV-first sourcing from private sellers: running serial checks, provenance verification, and condition grading to derisk acquisition while protecting margin.

-

Brokering with intent: using escrow, third-party authentications, and precise scope of work with both sides to keep fees clean and disputes low.

-

Client experience SOPs that turn one-off buyers into repeat clients through service reminders, strap upgrades, and rapid sourcing on wanted lists—raising lifetime value without paid ads.

-

Tax-aware recordkeeping for a trading operation: reconciling purchase/sale invoices, shipping/insurance, and service costs to simplify year-end filings (with the usual caveat to consult a licensed professional for local rules).

Methodology: Why the approach works

Focus beats frenzy. By narrowing to references you can price with conviction and buyers you can serve repeatedly, you escape the hamster wheel of small spreads. The program’s philosophy—bigger margins, fewer deals—makes room for meticulous sourcing, superior client treatment, and cleaner exits.

Systems beat luck. Margin floors, BCV sourcing, and pre-sold exits are systems; they remove variance. When you string them together with tight shipping/insurance SOPs and documented comps, you compound advantages across each stage.

Reputation compounds. In luxury, trust is a profit center. An organized process—auth, photos, disclosures, punctual shipping—earns repeat buyers. Over time, deal flow and off-market opportunities expand, lifting average spreads.

Common pitfalls this course helps you avoid

-

Chasing volume with razor-thin spreads that collapse under returns or minor service surprises; Part Deux teaches quality over quantity via selective brokering and premium retail exits.

-

Over-inventoried capital from impulse buys with no exit map; emphasis on cash-flow rules and buyer benches reduces idle stock.

-

Price-only positioning that attracts penny-pinchers; the bespoke client framework shows how to charge for speed, certainty, and sourcing skill.

-

Compliance and logistics missteps (paperwork, shipping/insurance gaps) that erode margins; the broader WTA ecosystem highlights operational polish as non-negotiable.

Conclusion

For practitioners who want to elevate watch flipping into a durable, high-margin business, Watch Trading Academy: Part Deux – Advanced Training (2022) provides a rigorous blueprint. It extends the foundational course into a professional operating system—covering BCV-anchored sourcing, 20%-plus margin engineering, bespoke client service, brokering ethics, inventory and cash-flow discipline, and the practical realities of taxes and documentation. The promise of 10+ hours of advanced instruction, personal deal case studies, and a pathway to higher-tier coaching signals that Part Deux is built for traders intent on consistent five-figure months and a clear road to six figures per year—achieved with fewer, better deals and cleaner processes. If your aim is predictability, reputation, and capital efficiency in a competitive luxury market, Watch Trading Academy: Part Deux – Advanced Training (2022) is engineered to make that transition real.

👍Take your watch business pro—enroll in Watch Trading Academy: Part Deux – Advanced Training (2022) and start building bigger margins on fewer, better deals today.

Reviews

There are no reviews yet.