🧩 Exploring the Power Behind The Hedge Hog Options Spread | Instant Download!

The Hedge Hog Options Spread (522 MB, $30.8) is a unique options strategy designed for traders who demand both consistency and extremely high win probabilities. Built by NavigationTrading and refined through real-world execution, this course introduces a trading method that can achieve success rates above 85%—a rarity in the options world. Instead of relying on guesswork, volatility spikes, or complicated indicators, the Hedge Hog approach uses probability, skew analysis, and structured setups to create reliable income.

This program is different from typical option spreads. It can be used as a standalone income generator or as a strategic hedge to reduce risk on existing positions. This makes the strategy attractive to traders who want both profitability and durability through different market conditions. Each lesson in the course builds on the previous one to help you understand not just how to execute the Hedge Hog, but why it works in varying market environments.

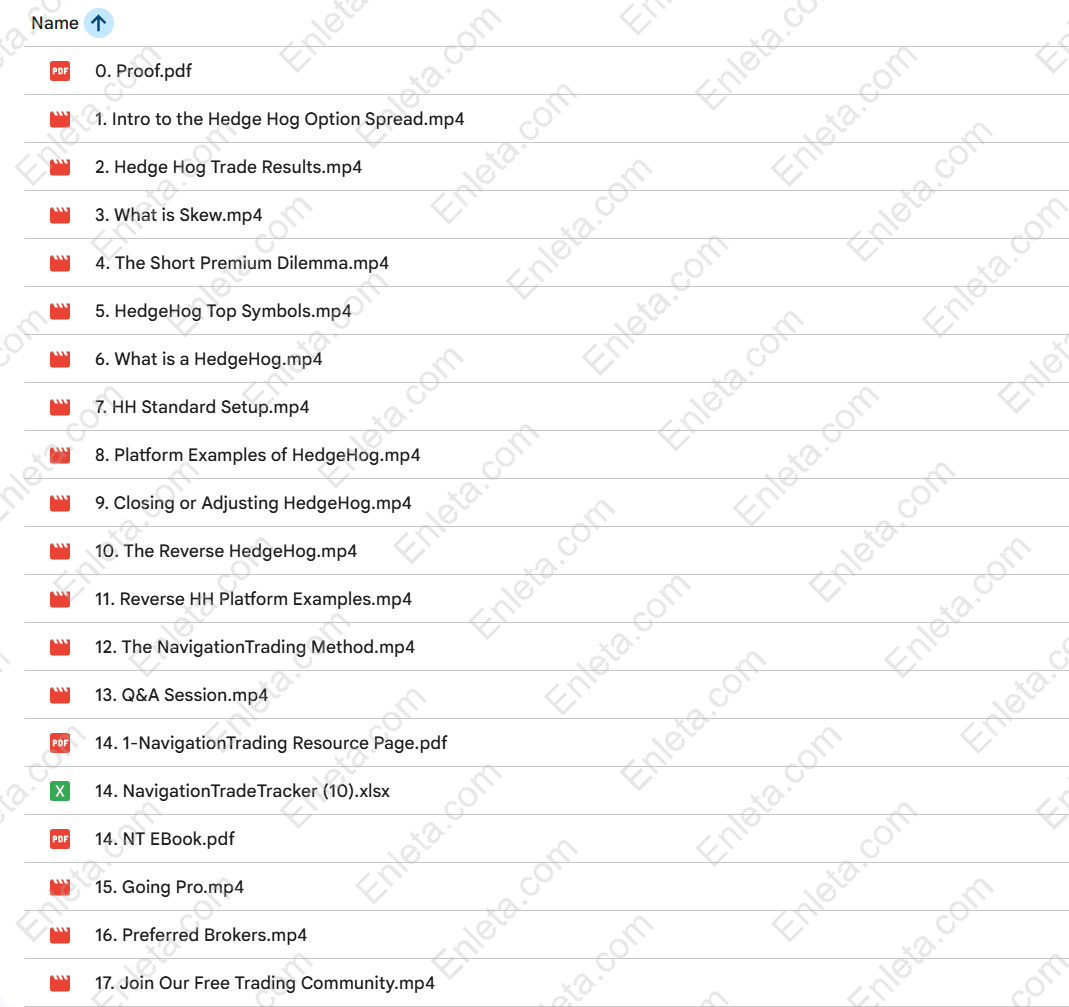

💼 Free Download The Hedge Hog Options Spread – Verified High-Quality Content Included

Get instant access to our official, verified materials — designed to deliver trusted, professional content you can use right away.

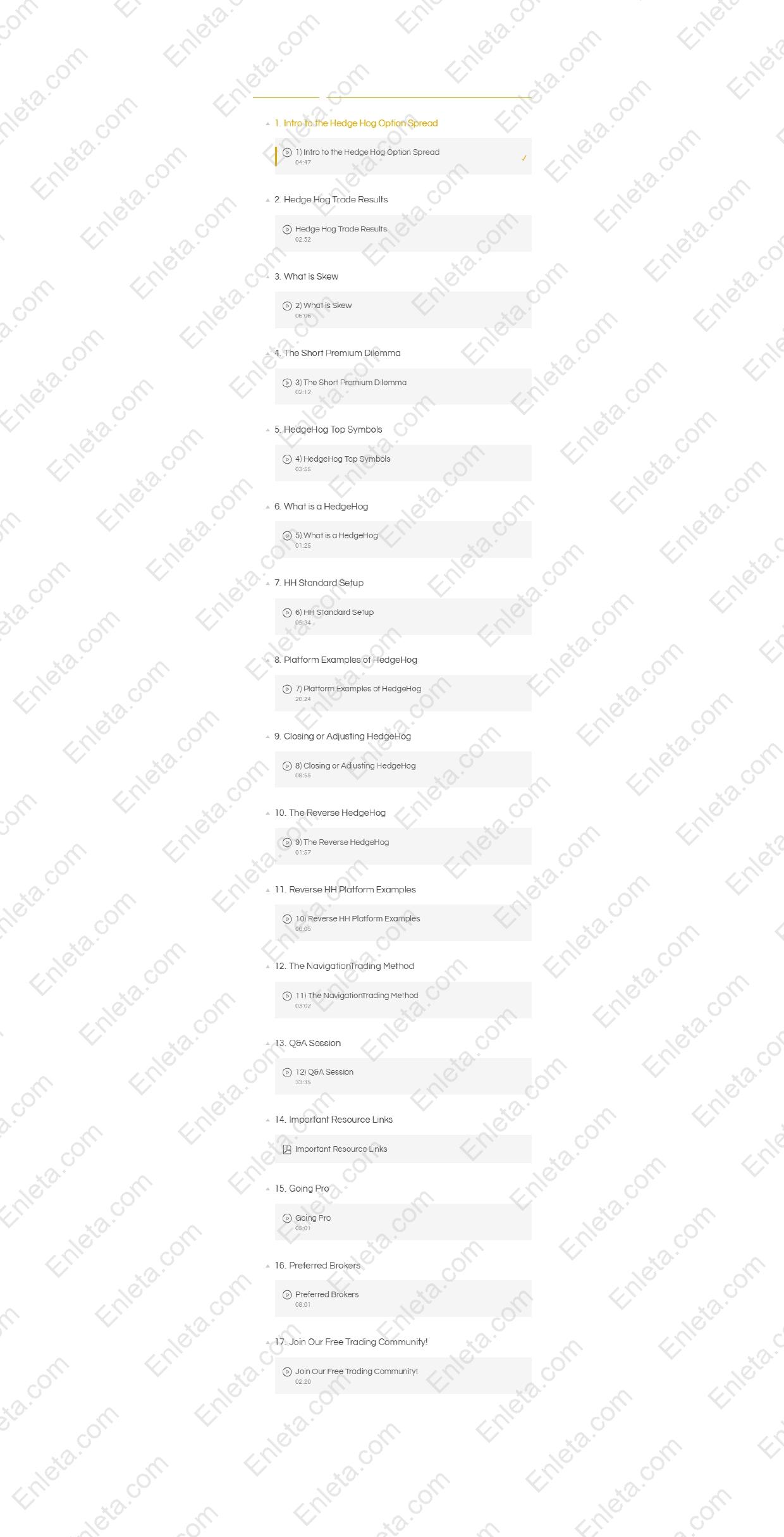

🎬Intro to the Hedge Hog Option Spread – Watch the Official Video Sample:

Preview the full experience through our official video and see exactly what’s included in the downloadable version.

✅The Hedge Hog Options Spread – Verified Proof of Content Quality:

Explore verified credentials and quality assurance details confirming the authenticity and accuracy of the material.

📈 Why Traders Choose the Hedge Hog Options Spread for High-Probability Income

One of the main reasons the Hedge Hog Options Spread stands out is its exceptional win rate. Most income strategies achieve 60–70% probability of profit at best, but the Hedge Hog routinely exceeds 85%. This level of reliability comes from structuring the spread around skew, volatility imbalance, and carefully selected symbols that offer predictable behavior.

The method teaches you how to create high-probability setups where the market does not need to move aggressively for the trade to succeed. Even neutral, slow-moving, or choppy conditions can produce profitable outcomes. This makes the Hedge Hog Options Spread especially appealing for traders seeking stress-free consistency.

Key performance advantages include:

-

Trades can profit when the market moves up, down, or sideways

-

Minimal chart watching required

-

High stability in uncertain market conditions

-

Ability to hedge other open positions

-

Structured adjustments to repair trades that go wrong

The real value appears when combining the Hedge Hog with professional risk management. The course emphasizes controlling exposure, adjusting effectively, and using skew to your advantage. When applied correctly, the approach offers one of the most robust probability-based systems available.

🎛️ Inside the Mechanics of The Hedge Hog Options Spread

The Hedge Hog Options Spread is built around pricing dynamics, option skew, and strategic premium selling. Instead of relying solely on directional bias, it focuses on capturing premium in areas where probability strongly favors the trader. The approach blends short premium with hedging structures that balance risk while maintaining a strong likelihood of profit.

Students learn:

-

How the Hedge Hog structure is built

-

Why skew matters and how to exploit it

-

How to place entries based on volatility profile

-

How to choose symbols with ideal probability characteristics

-

How to execute spreads that offer room for error

-

When to adjust, close early, or reverse the position

This focus on structural understanding allows traders to approach the market with clarity instead of emotional decision-making. The Hedge Hog Options Spread provides a repeatable formula for income regardless of market personality.

🧠 Core Concepts You Will Master

-

Using skew differences to find pricing advantages

-

Managing naked components safely with defined rules

-

Identifying symbols with historically predictable ranges

-

Adjusting Hedge Hog positions logically, not emotionally

-

Understanding when a reversing Hedge Hog setup is more effective

🧪 What You Will Learn Throughout the Hedge Hog Course

The course is built on a well-organized lesson flow that guides students from core principles to advanced execution. Each video is designed to bring clarity to a specific part of the Hedge Hog Options Spread, ensuring deep understanding and confident application.

Here is a breakdown of the main learning components:

-

Introduction to the Hedge Hog structure

-

Reviewing Hedge Hog trade results

-

Understanding option skew and why it matters

-

The short premium dilemma and how Hedge Hog solves it

-

Top symbols to trade and symbols to avoid

-

What a Hedge Hog truly is and how it behaves

-

The standard Hedge Hog setup

-

Platform walkthroughs demonstrating real placements

-

How to adjust Hedge Hog positions

-

Reverse Hedge Hog setups

-

The NavigationTrading method for consistent execution

-

Extensive Q&A session covering practical challenges

Each section builds toward mastery. Real examples, platform demonstrations, and strategy variations help you clearly see how to apply the Hedge Hog Options Spread across different market environments.

📊 Benefits of Using the Hedge Hog Course in Your Trading

Because the Hedge Hog Options Spread is probability-driven, it offers several benefits that traditional directional strategies lack. Instead of relying on perfect timing or large price movements, this strategy thrives on consistency and structure.

Traders gain:

-

High win rates with manageable risk

-

Flexible setups that adapt to volatility

-

Increased confidence through rules-based trade selection

-

A steady flow of income opportunities

-

A hedge for directional portfolios

-

The ability to trade without constant screen time

The Hedge Hog method strengthens discipline, improves risk perception, and helps traders approach the market professionally. When combined with proper symbol selection, the strategy becomes a reliable income generator supporting long-term growth.

🎯 Skills You’ll Develop Through This Program

The Hedge Hog Options Spread is not just a strategy—it’s a complete skill-building system. Traders who complete the course consistently report improvements in timing, risk management, and decision-making under pressure.

Throughout the training, you will develop:

-

A deeper understanding of skew and premium pricing

-

Knowledge of when a trade truly has high probability

-

Ability to evaluate symbols more intelligently

-

Execution confidence for advanced spread structures

-

Skill in adjusting and repairing trades efficiently

-

A structured framework for evaluating option opportunities

These skills transfer across all options strategies, making the Hedge Hog a strong foundation for traders aiming to go professional.

👤 Who Should Take the Hedge Hog Course

This program is not designed for beginners. The strategy involves naked components and requires real understanding of risk. The Hedge Hog Options Spread is best suited for experienced traders seeking a sophisticated, high-probability method.

You should consider this course if you are:

-

An intermediate or advanced options trader

-

Someone who wants to stabilize trading results

-

A trader seeking income strategies that require minimal screen time

-

Someone managing larger accounts

-

A trader frustrated with inconsistent directional setups

-

Looking for a robust hedge to reduce portfolio risk

With a recommended minimum account size of $50,000, the Hedge Hog approach is meant for serious traders ready to elevate their methodology.

🧑🏫 About the NavigationTrading Team

The Hedge Hog Options Spread is taught by the NavigationTrading team—known for practical, probability-based option strategies that work in modern markets. Their teaching style is structured, data-driven, and focused on clarity. Instead of presenting complicated theories, they break concepts down into simple, actionable processes.

Their experience includes:

-

Real-world trading across varying market regimes

-

Deep understanding of option behavior and volatility

-

A proven history of high-probability strategy development

-

A commitment to helping traders build long-term consistency

Their instruction makes advanced ideas highly accessible, even when dealing with complex structures like the Hedge Hog.

The Hedge Hog Options Spread (522 MB, $30.8) is a powerful and highly specialized trading strategy designed for experienced options traders seeking consistent profits through structured, high-probability setups.

❓ Mini FAQ – Fast Answers for Students

❓ Is the Hedge Hog strategy beginner-friendly?

No. It is recommended for intermediate traders with larger accounts.

❓ Can the Hedge Hog be used to hedge other positions?

Yes. It is one of the strongest features of the strategy.

❓ What makes the win rate so high?

Probability structure, skew exploitation, and smart premium placement.

❓ Do I need to monitor trades constantly?

No. The method requires minimal screen time once placed.

❓ Does the course include platform examples?

Yes—multiple real examples are included.

Can’t find the course you’re looking for on Enleta? Contact us and we’ll help you locate it.

🔥 Final Thoughts: Why This Strategy Is Worth Learning

The Hedge Hog Options Spread (522 MB, $30.8) offers traders a rare combination of stability, consistency, and high-probability profits. With win rates exceeding 85% and flexibility across multiple environments, it stands as one of the most powerful tools for serious options traders. The course arms you with structured setups, adjustments, symbol selection frameworks, and real examples—everything needed to trade confidently.

👉If you want a strategy built on probability, discipline, and professional insight, this is one of the strongest advanced options courses available today.

Reviews

There are no reviews yet.